Rates Rising to Open 2025

February 8th, 2025

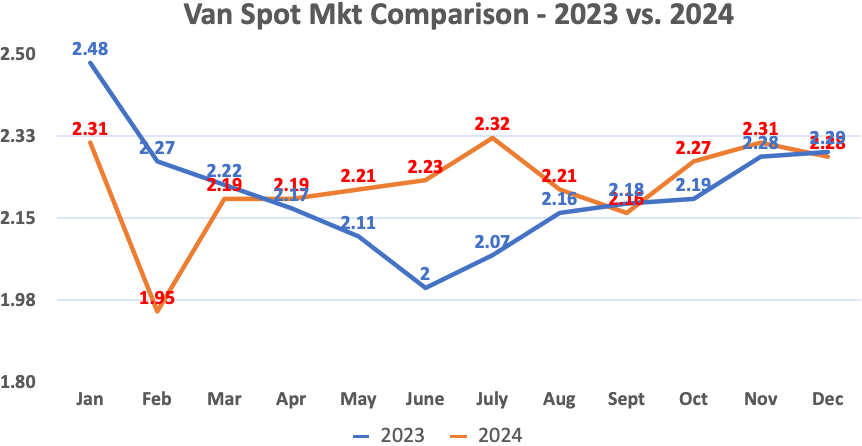

January Results

Spot market demand measures rose in January and rates followed. Once a dormant month, January has produced strong rates the past three years due to fulfillment, winter weather, and post-Christmas sales. In the Transport Pro data, flatbed and reefer equipment showed the strongest climb, but the van segment also performed at a 12-month high, tied with July.

It's rare for all six equipment types to show positive month-month results. Yet that occurred for January as stronger underlying factors smacked into a strong dose of winter weather.

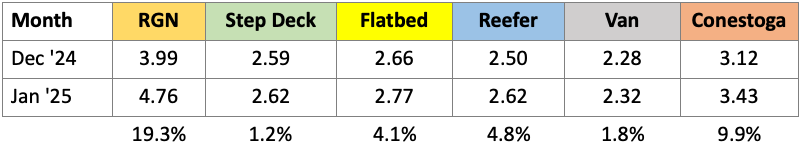

Month-Over-Month Comparison

Reefer equipment came into strong demand as the polar vortex covered most of the easternmost states down to the Florida panhandle and southern Louisiana. Sub-zero temperatures require heat for a large host of commodities that travel on van trailers for at least part of the year. Reefer rates jumped twelve cents, up 4.8%. Some movement on construction is indicated by outsize jumps in RGN and Conestoga rates. These rates are volatile due to a much smaller population being sampled, still the jump implies a strong uptick.

Year-Over-Year Comparison

Van rates are only a penny better than as measured one year ago but optimism prevails. Most economists expect a robust year in 2025 with ongoing worries about inflation and a lack of interest rate cuts providing the counter concern. Reefer rates were stronger in January 2024 but then fell in subsequent months, so achieving $2.62/mile is actually a positive. It's the second highest rate since January 2022!

Strong metrics around construction and new home starts will help. Tariffs provide uncertainty and may drag cross border traffic levels lower will which counter new construction. The trifecta of much stronger flatbed, RGN, and Conestoga demonstrates an underlying activity taking place. New oil well starts are sluggish which has a big impact on flatbed rates when activity is high. Broker margins are healthy for the flatbed and specialty decks, except in Conestoga equipment, which may be harder to book in the winter, hence margin compression.

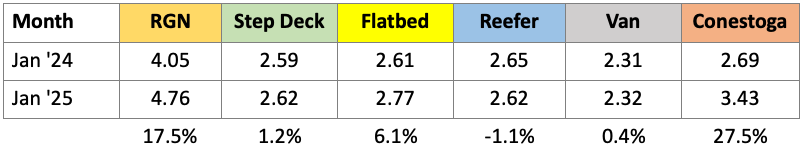

VAN Rate Statistics

Two different stories in 2023 and 2024 led to pretty much the same ending for van freight. Van is starting out at $2.32/mile in January 2025.

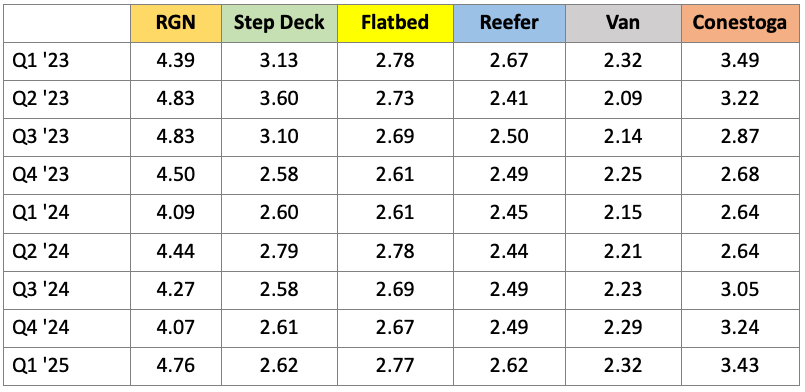

Quarterly Results

Quarterly results are higher for five out of six categories. Van, reefer, and flatbed are all recovering. RGN and Conestoga are hitting levels not seen in over a year-and-a-half. Step Deck hasn't hit as high of numbers due to less activity in the Texas oil fields.

Long Term Rate Data

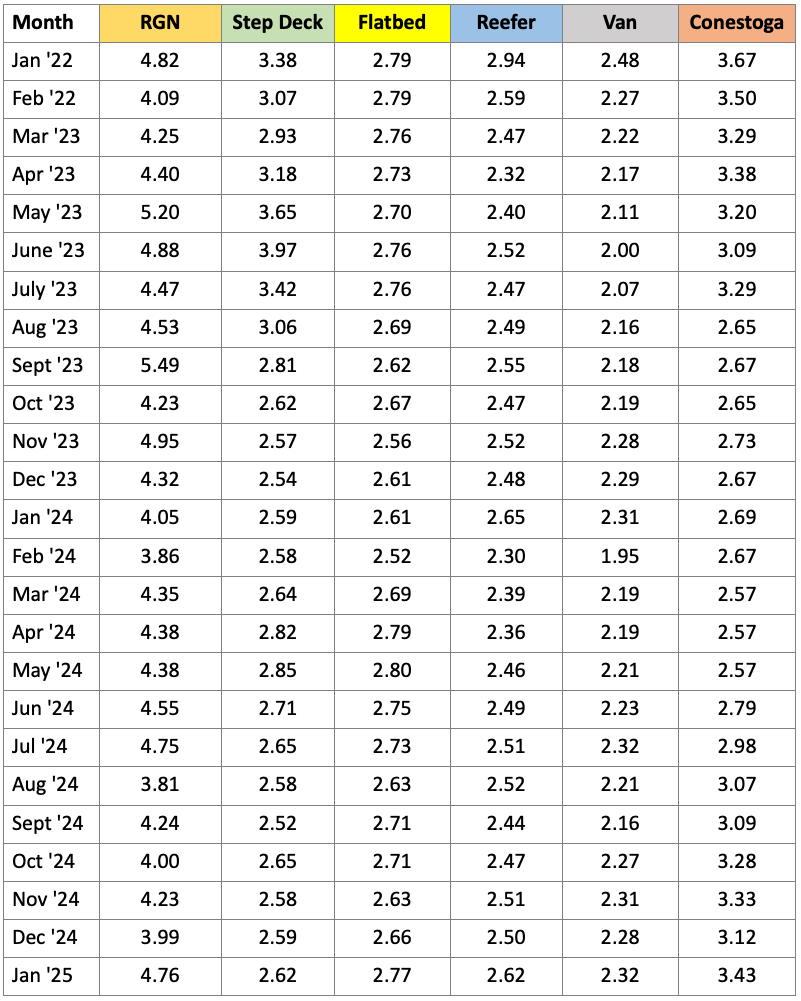

The running monthly compilation of rates in six categories. Only Transport Pro breaks out RGN, Step Deck and Conestoga equipment from the Flatbed group.