Most Rates Tumble, Margins Remain Compressed

Date: March 6, 2025

February Results

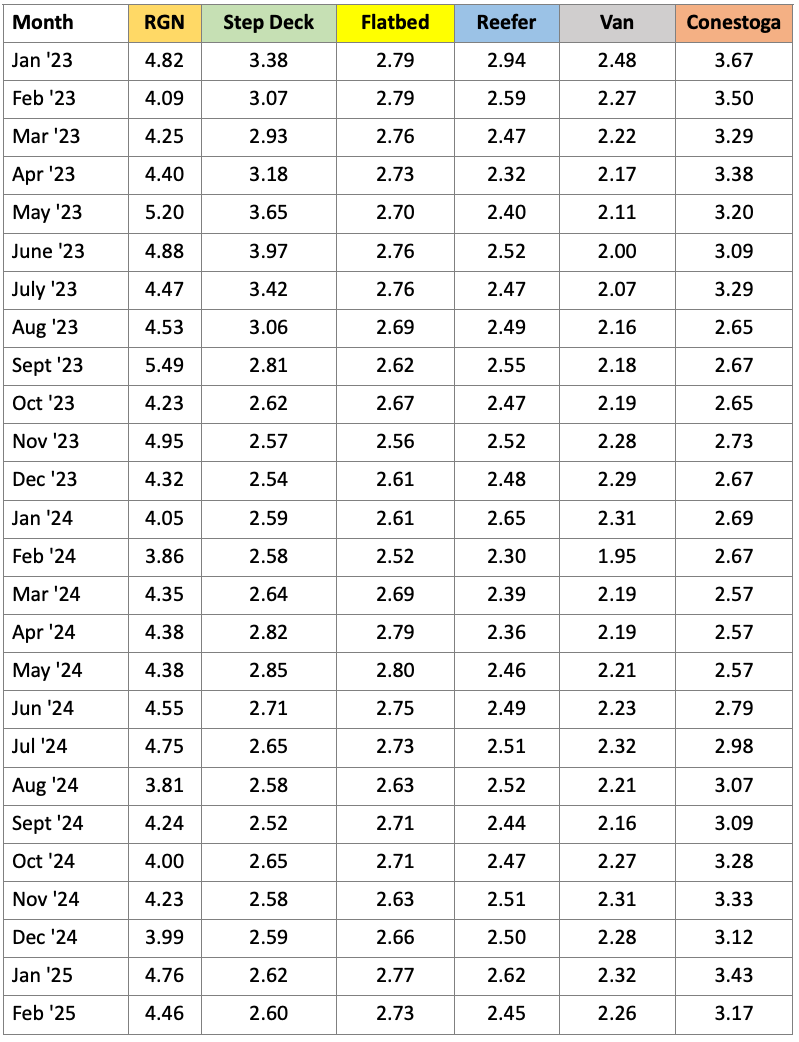

All categories registered lower rates in February vs. January 2025. Volumes also dropped by about 14% but there were just 20 working days in the month vs. 22 working days in January. Rates and volumes usually do slip somewhat in February. For most of my 38 years in transportation that has been the case and some years have seen exceptional drops.

Fuel costs remain lower to open 2025 and rates are better than last year across-the-board so the numbers aren’t altogether bad. Rather the uncertainty around tariffs and near-term outlook are clouding carrier perceptions. For brokers, margins remain compressed at just 14.3% overall. Lower margins on van freight remain the biggest concern, flatbed margins are generally holding up.

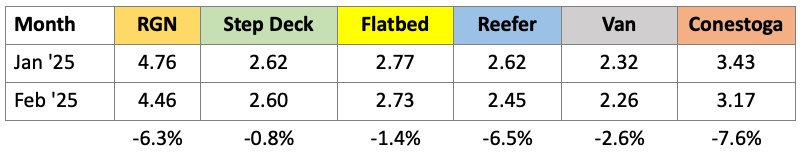

Month Over Month Comparison

The most notable drop occurred in refrigerated freight with a drop of 17 cents or 6.5% lower. Fewer fresh fruits and vegetables are shipped during February, still that’s a significant downward movement. The van drop of six cents or 2.6% lower can be attributed to seasonality. Perhaps the move in January to 'beat' tariffs resulted in smaller van volumes. That would explain sharper drops in van freight than in flatbed and reefer.

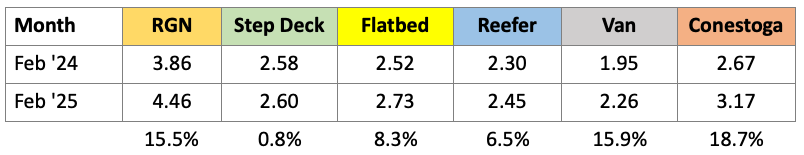

Year Over Year Comparison

The year-over-year results actually look quite positive. If you recall February 2024, it was awful. It’s good to step back with a longer-term view and see more strength in rates, especially van which is up 31 cents or +15.9% from one year ago. Flatbed rates at $2.73/mile match the July 2024 level. RGN and Conestoga are doing even better as a percentage but demand for Step Deck appears to be stagnant.

Refrigerated metrics have been a concern for some time. Broker margins for reefer freight hit a low of 12.0% in January but rose to 13.3% in February, which matches December. The anticipation is that the US will export lower volumes of food to Canada and Mexico while imports also have a drop. The US produce season starts in March with volumes from the Rio Grande Valley of Texas and Imperial Valley in California.

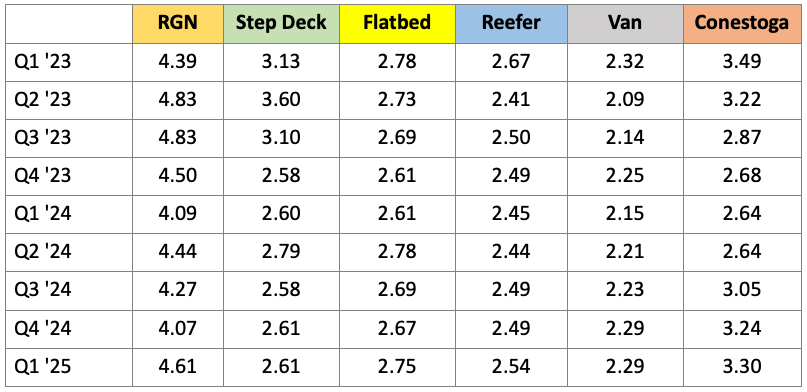

Quarterly Results

Quarterly results are higher for four out of six categories. Van continues to match the 4th quarter of 2024 result. The Baker-Hughes Rig Count Overview shows that the US is down 36 drilling rigs from one year ago. The oil field activity has an impact on flatbed loads as machinery, pipe and drilling equipment consist of large numbers of flatbed loads in Oklahoma, Texas, and North Dakota.