March Rates Underperform, Send Mixed Message

April 7, 2025

March Results

A rebound in March freight volumes did not produce the higher rates expected for van and refrigerated traffic. Flatbed rates held as we transition into the Spring construction season. Broker margins did improve on van and reefer traffic which shows some expectation on clients' behalf that rates will hold. Average length of haul shows longer trips for van and reefer traffic, perhaps due to increased domestic sourcing. This may, at least in part, explain drops in rate levels as longer trips are more productive i.e. less sitting and more driving. The increased length of haul also hints at changing freight mixes.

Diesel fuel costs are 40.4 cents lower on a national basis this week, 3/31/25 versus one year ago. This provides some tail wind to carrier operations as does slightly declining capacity - which has been documented by other sources of spot market data. Volatility generally leads to an uptick in spot rates and the impact of tariffs will lead to changes in the source and distance hauled of many commodities. Moving away from the supply chain model of foreign production to domestic production could lead to more lucrative spot hauls, at least until new traffic lanes become well established. The U.S. has been in a freight recession for over two years, so the negative impact on the freight economy is at less risk than the general economy.

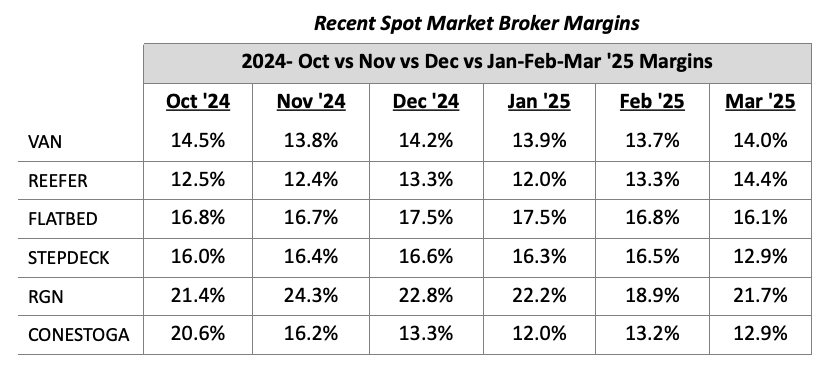

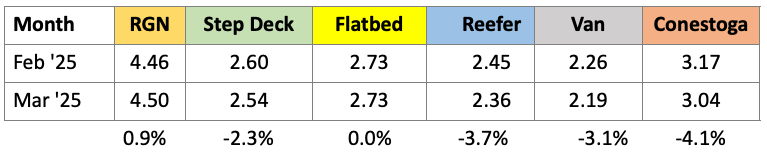

Month-Over-Month Comparison

For the 2nd consecutive month, van and reefer rates have a significant decline. Van rates are down seven cents per mile or -3.1%, reefer rates declined nine cents per mile or -3.7%. This may have several potential causes and rates remain stronger than they were one year ago. Meanwhile the flatbed segment held even as margin dipped from 16.8% to 16.1%. Van margins rose from 13.7% to 14.0% and refrigerated margins rose from 13.3% to 14.4% in Transport Pro data.

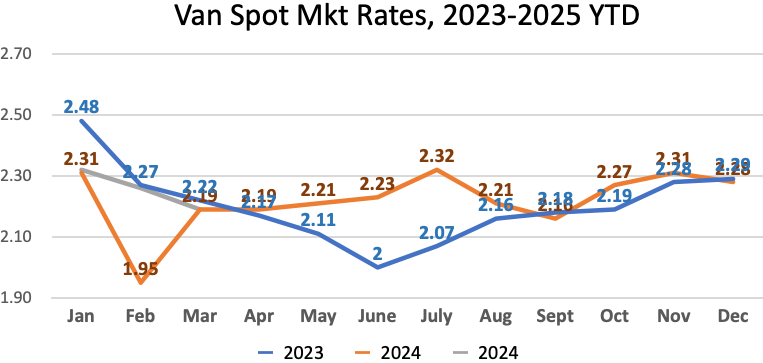

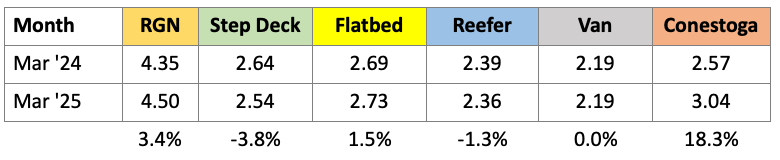

Y-O-Y Comparison

The year-over-year results look much like 2024 numbers. In fact, van rates are at $2.19/mile both months. Reefer rates are slightly down, three cents at $2.36/mile. Flatbed rates are up six cents at $2.75/mile.

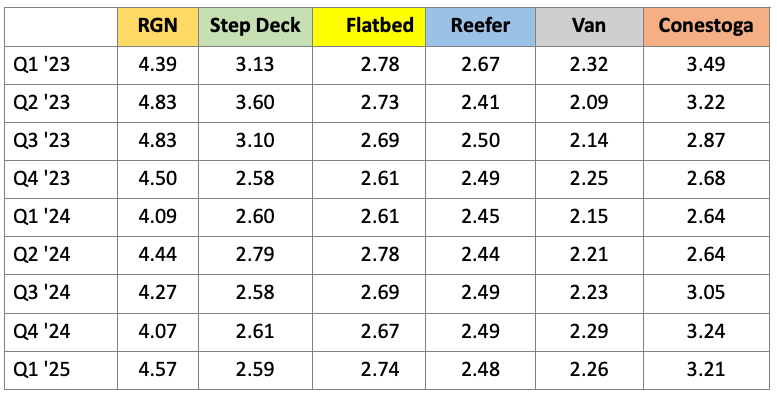

Quarterly Results

Quarterly results are eight cents per mile higher for flatbed freight. Otherwise, quarterly change shows no significant change in the spot market freight rates. Overall, the quarterly volumes have held - meaning there is no recessionary signal in the data. Changes in length of haul are interesting but preliminary as the last nine months have shown fluctuating numbers. April will need to show stronger numbers than March or it will begin to signal a downturn in freight.