Economy Manages Soft Landing - Rates Firm, Fuel Drops

Report Date: December 1, 2024

November Results

November continued trends seen in October, van and reefer rates rose while flatbed rates seasonally declined. In context, it can be declared that the U.S. economy, long feared to be facing a recession, has achieved a ‘soft landing’. Interest rates and inflation are easing which constitute the two main economic worries.

Truckers have had a tough year due to overcapacity and high fuel prices. According to load board data, I see fewer truck postings which indicate that capacity has left the marketplace, The change results in higher load-to-truck ratios. There may also be less spot market freight currently but the market is poised for contract rates to rise going into 2025, which will assist spot market rates to remain viable.

The other factor, fuel prices, needs to be considered as well. Spot prices are ‘all-in’ containing an implied fuel surcharge. With fuel down ~55 cents Y-O-Y (and about a dollar/gallon from the September peak of $4.56/gallon), operating costs have dropped for most fleets. While pricing fails to show a strong difference from 2023 for most segments, the linehaul cost excluding fuel is much improved. This provides for ongoing optimism and businesses looking to meaningfully expand in future quarters.

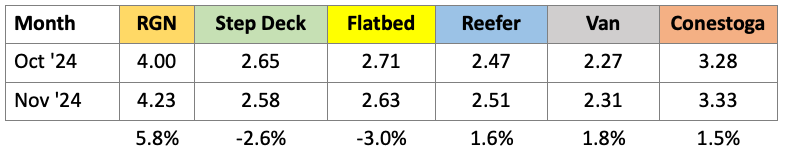

Month Over Month Comparison

Van rates have risen in back-back months. The latest increase is just four cents or 1.8% but that bucks a trend that usually sees September/October as peak months. Reefer rates saw a similar increase with the advent of colder weather and early intense snow in many parts. Flatbed and Step Deck rates dropped seasonally but Conestoga and RGN rates ran counter, showing that certain segments remain strong.

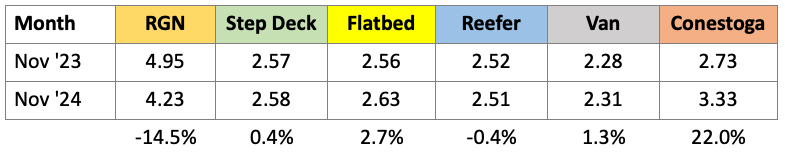

Year Over Year Comparison

Flatbed rates show the biggest surprise on this comparison, up seven cents or +2.7%. Otherwise, reefer and van rates are not much changed in the past year while the previously noted fuel prices have sharply dropped. RGN and Conestoga rates have had large swings but represent relatively low volumes and may be more lane specific rather than an indicator of an overall decline/increase. Length-of-haul and lane balance are also important factors when comparing rates. Usually, large data populations tend to wash out these factors.

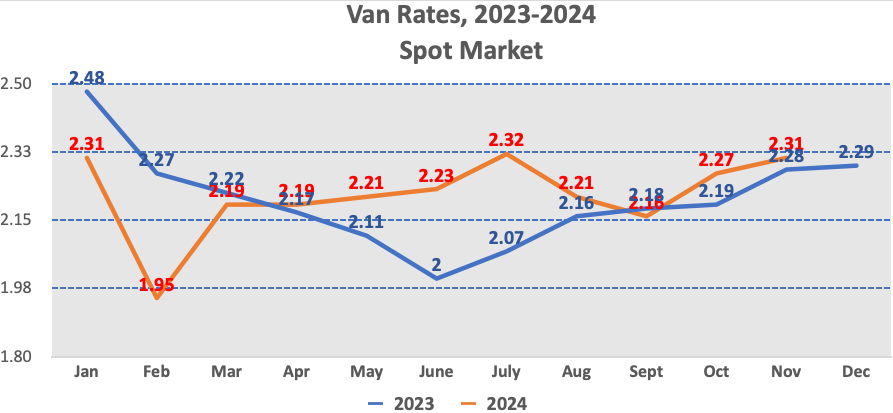

VAN Graph

October plus November provide seven months of van rates outperforming 2023. Only in September did van rates falter in the past eight months.

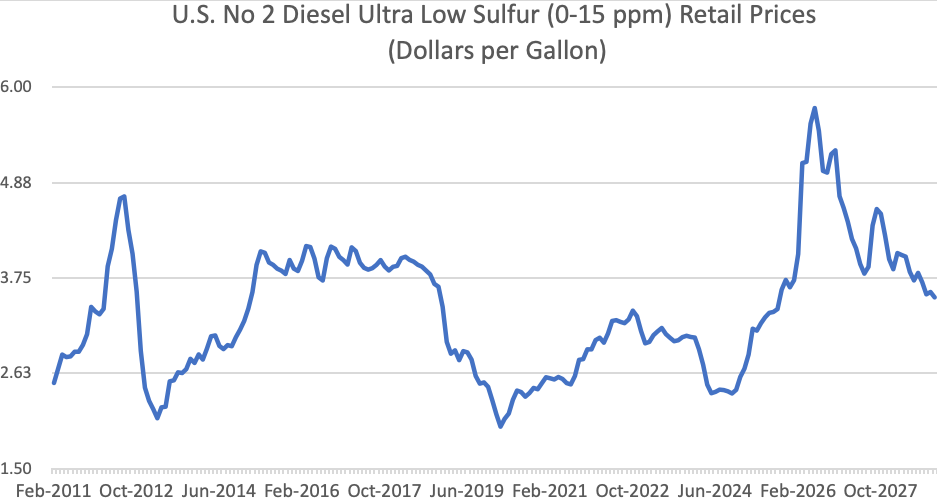

Historic Diesel Fuel Prices (Source: DOE: Energy Information Administration)

Increased U.S. production of oil through fracking and horizontal drilling first stabilized the price of oil from 2011-2015, then created a surplus which dropped the cost of diesel fuel to a low of $1.998 in February of 2016. Prices then spiked following another dip in 2020 to a peak of $4.563 as a national average in September of 2023. Prices have sharply declined for diesel fuel to the current national average of $3.552/gallon over the past year.