August Slump Hits Rates & Margins

Report Date: Sept 1, 2024

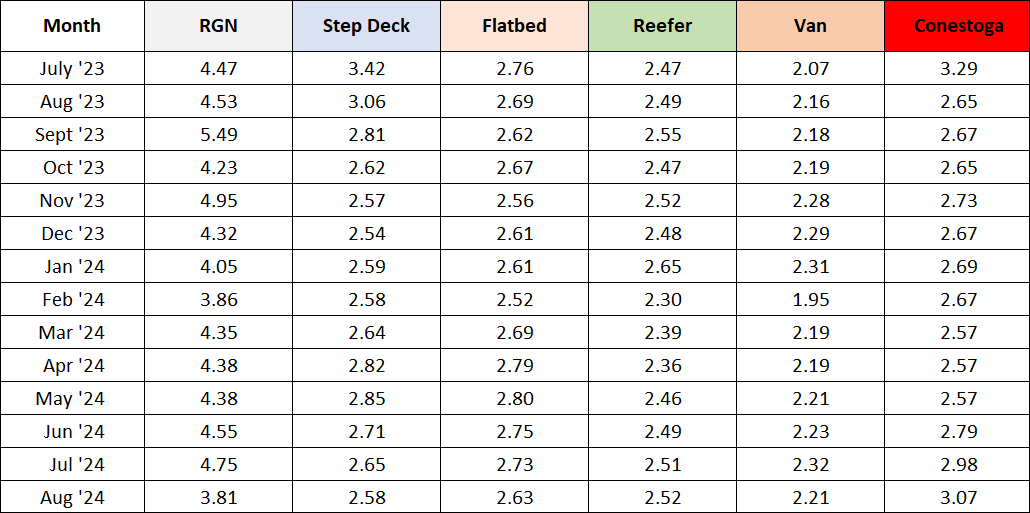

This last month weaker results had been anticipated based on current economic metrics and historical basis. Analysis of the Transport Pro database confirmed those expectations and if anything, the slump showed worse results than hoped. Not only did van and flatbed rates slump, but margins were down for van and reefer freight. Specialty flatbed freight fell by double digits on a Y-O-Y basis.

August lowlights

Van freight. Van rates dropped eleven cents per mile back to the May level of $2.21/mile. Brokers didn’t benefit either as van margins dropped from 14.4% to 13.4%, which is the lowest number this analyst has seen in more than twelve years of observations. Flatbed rates also slipped, with standard deck freight falling from $2.73/mile to $2.63/mile. Brokers saw flatbed margins improve though, from 15.1% to 15.6%.

Looking at the refrigerated segment, rates remained stable at $2.52/mile. Refrigerated broker margins slipped from 12.4% to 11.8%. Overall, broker margins dropped from 14.2% to 13.6%. Are there any bright spots? Step deck rates dropped from $2.65/mile to $2.58/mile but brokers were able to earn a 17.4% margin on that segment. Also, earnings on short haul and LTL freight beat the prevailing sour results.

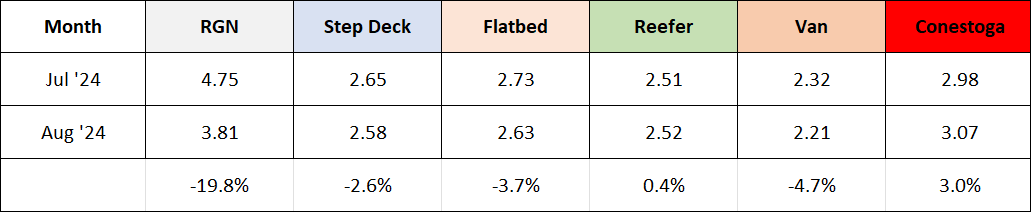

Month-Over-Month Comparison

New construction may be flagging seasonally and with little relief from interest rates, the flatbed segment has begun to suffer. Standard deck rates are down at -3.7%, RGN rates tumbled nearly 20% lower and Step deck slipped, -2.6%. Given the smaller data sets for these last two segments, bigger swings can occur but these drops stand out as showing a real slow down. Total spot moves in July and August were comparable; in a more typical year, August should show an increase in the number of loads. Reefer segment rates held up.

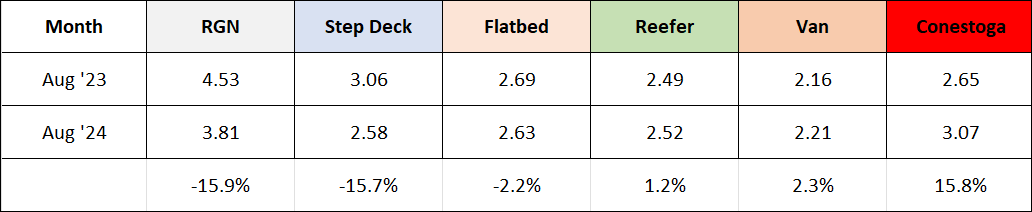

Year-Over-Year Comparison

Reefer and van both showed a positive change from 2023 comparable figures. But flatbed is lower and specialty flatbed is down more than 15%. Interestingly, Conestoga freight recovered to achieve +15.8%. Even though reefer and van rates are up Y-O-Y, costs are up more putting increasing pressure on operators.

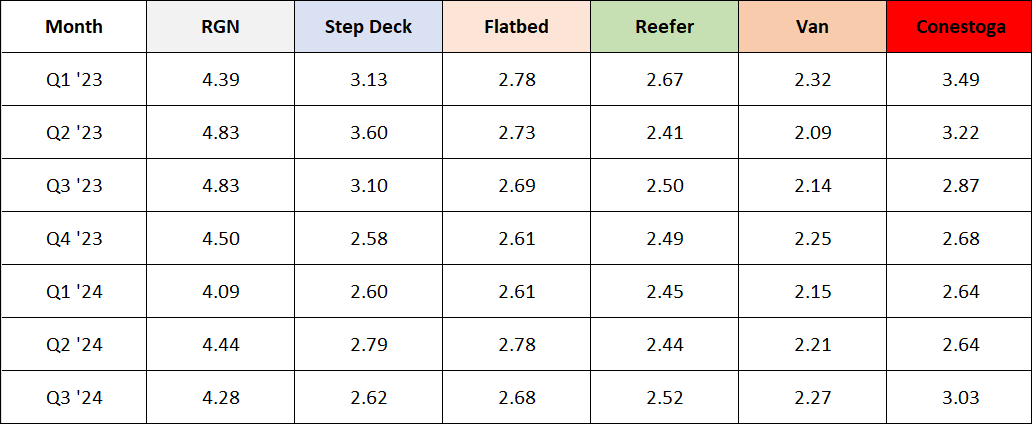

Larger picture - Look by Quarter

Here are quarterly results which provides a different way of looking at twenty months of data less subject to monthly swings. *July and August represent the 3rd quarter 2024.

All flatbed categories are lower in the 3rd quarter except Conestoga. Reefer and Van rates remain up due to solid July results. No rates have recovered to 1st quarter 2023 levels.

2nd Half Outlook

Expectations remain that the Fed will cut interest rates in September. This action is overdue and may be too late to save the Fall shipping season. Consumer spending may lift the 4th quarter. Infrastructure spending to hold rates in the flatbed segment appears to be missing. A shift from restaurants to fresh produce may be the root cause of lower margins on refrigerated freight.

September is always better than August but it’s questionable how much improvement can occur in one month’s time given the current weakness in freight. Rising unemployment represents another head wind. At least, gas and diesel prices appear to be stable to falling. But wages and wage demands are rising.

Broker & Owner-Operator (Purchased) 14-Mo. Recap