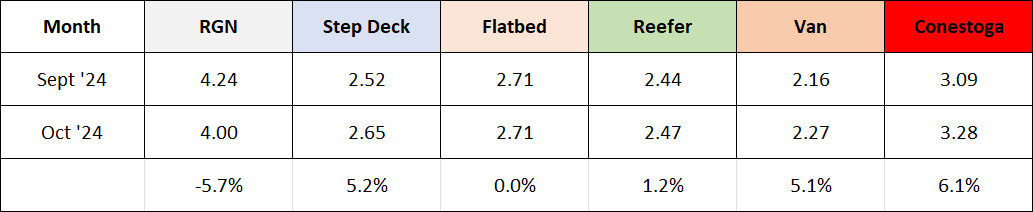

Resilient consumer spending drove van rates higher in October on both a Month-Over-Month and Year-Over-Year basis. Even as this news has been welcomed by small carriers, there hasn’t been much change in other freight segments as Flatbed remained unchanged and Reefer rates were only slightly higher. Still, this represents a positive change to start the 4th quarter.

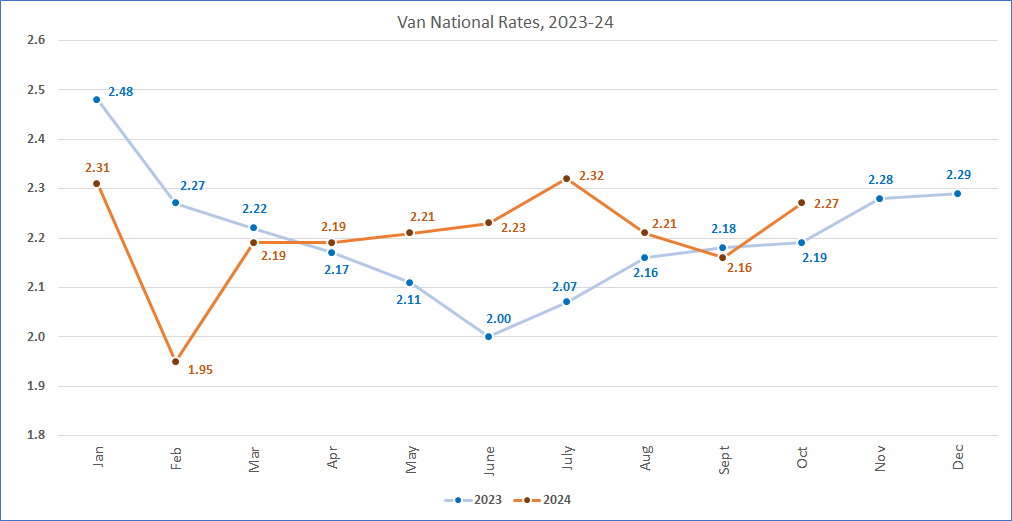

Van rates rose eleven cents to achieve $2.27 per mile or 5.1% higher to record the best month since July. Later in the broker margins discussion it will show positive change in this metric for vans as well. While flatbed rates were unchanged, reefer rates gained three cents per mile to $2.47. Step Deck and Conestoga results were also up significantly.

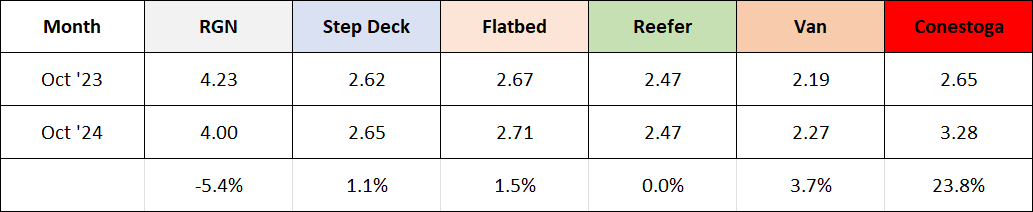

Van rates on this basis were up a modest 3.7% or eight cents per mile. Flatbed, Step Deck, and Reefer shipments were not significantly changed while RGN rates were down, -5.4%. But Conestoga rates have been performing well since July and jumped a very strong 23.8% higher than October 2023.

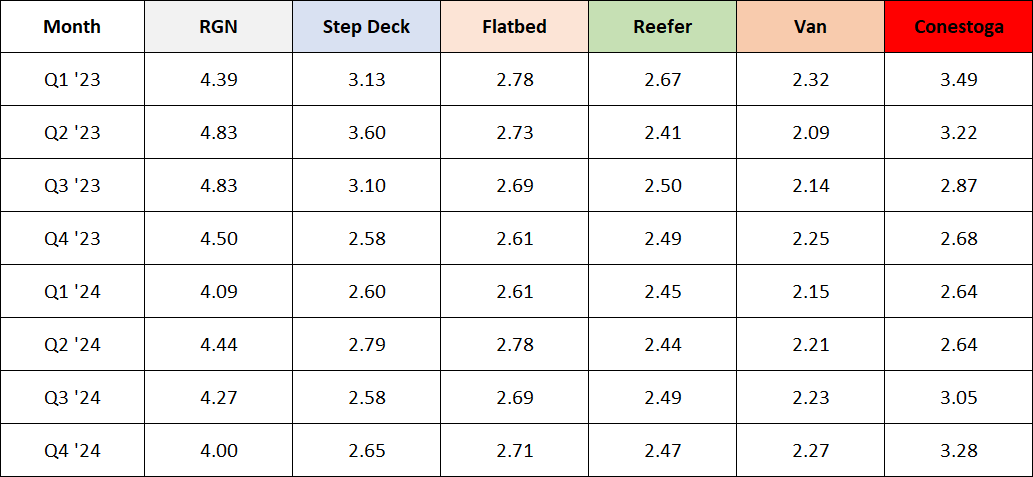

Interest rates are finally coming down with the economy performing a soft landing. While many segments remain challenged, these numbers indicate potential for industry recovery. Another interest rate cut should further spur higher demand for truckload freight on the spot market. Brokerage LTL and short haul markets were also checked and remain positive areas for brokerage earnings. Factored van shipments are performing a few cents better than the transactions in this data so there is more data to back this assertion of recovery.

We only have October data to represent the 4th quarter but there are a lot of positive factors. Lower interest rates for one, and the other is that despite a major strike against Boeing and widespread destruction from hurricanes in the SE Region, numbers held up. Storm clean-up and rebuilding should help flatbed segments in November and December. Refrigerated shipments should pick up as colder weather arrives with higher levels of foodstuffs for Thanksgiving and Christmas holidays.

September provided a concerning data point but October is back on track for van rates to outperform 2023.

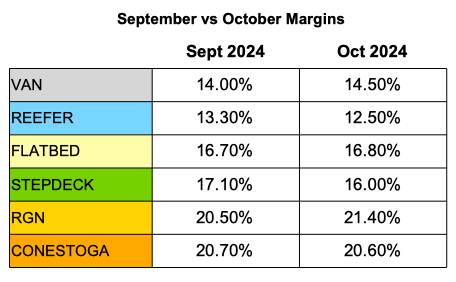

Van margins moved higher by a half percentage point but reefer margins moved lower. In the flatbed segment, almost no change. But LTL and short haul margins remain solid.