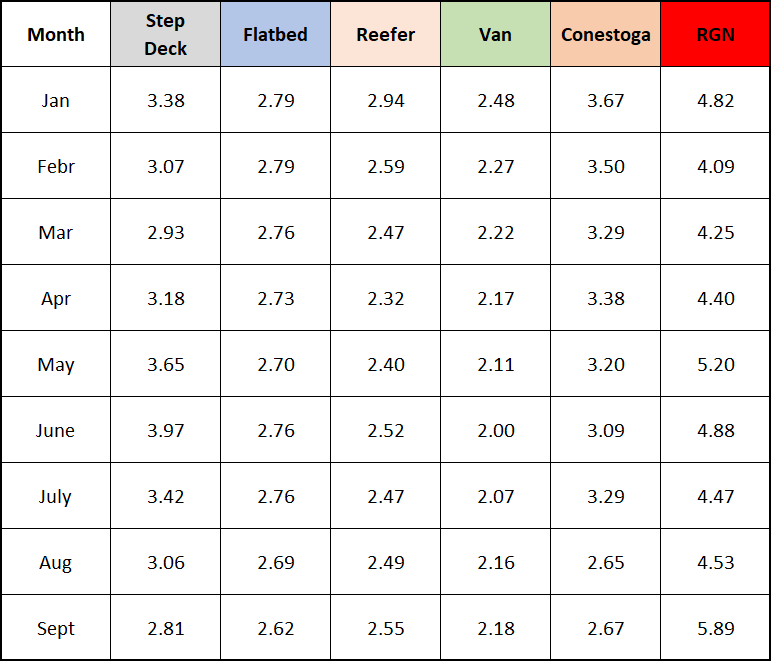

Analysis of Transport Pro database for the month of September shows improving metrics for refrigerated freight, very slight improvement for van, and seasonal declines for flatbed freight. The freight marketplace has been in recession during 2023 so any signs of historic trends is welcome news. An added plus for carriers is that fuel prices moderated with some declines at the end-of-month and beginning of October.

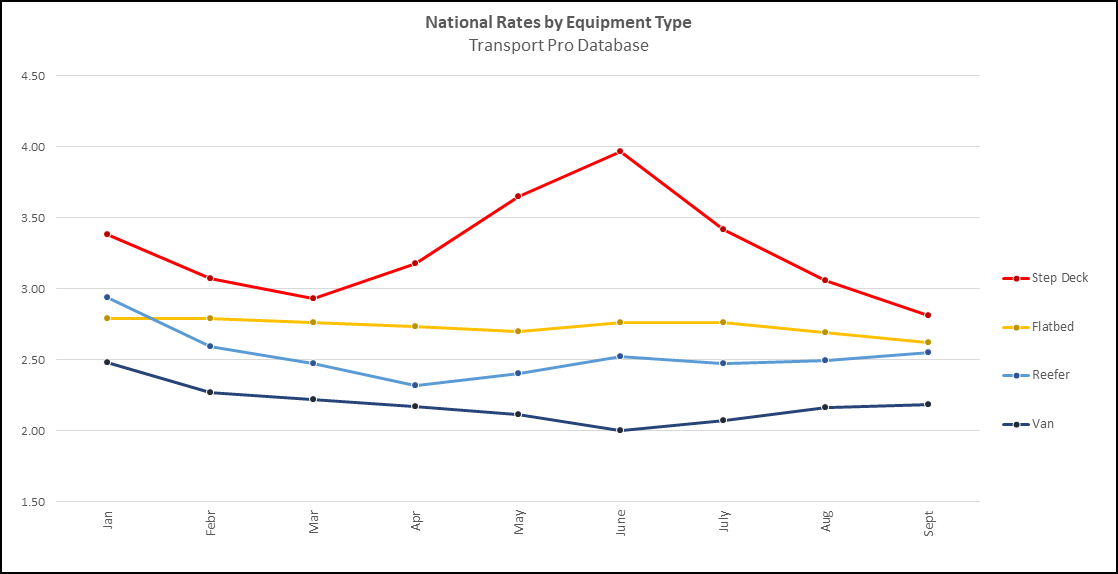

Historically, the 3rd quarter close of business has been one of the strongest periods for freight volumes, with tightening capacity. This year rate changes were modest but still significant enough to negatively impact broker margins. Partly that may be due to an exit of capacity due to the ongoing difficult conditions for truckers. The one bright spot for carriers of strong demand for specially flatbed equipment dropped off precipitously since June as shown in the graph below. Flatbed rates are plotted separately for Step Deck and standard 53’ flatbed equipment.

Notes

Rates include fuel surcharge, where applicable. Rates are paid to Carrier by Brokers

Trips over 250 miles only

Over dimension, overweight, hazmat, LTL moves removed

Each month based upon about 40,000 monthly moves; Van, reefer, flatbed make up 95% of shipments

Flatbed consists of 53’ standard deck shipments; specialty flatbed equipment reported separately