Not Quite June Peak Season Van and Reefer Rates Rise Modestly

July 8, 2024

Freight levels rose in the final weeks of the 2nd quarter helping van and reefer freight continue to modestly rise. Any observer of prior cycles would be hard pressed to call this month’s data as peaking but the data represent a welcome change from last years’ experience of falling rates. Note that flatbed did not participate in the rate rise as both Step Deck and standard 53’ flatbeds had declines. However, Conestoga rates were up as well as Removeable Gooseneck deck trailers.

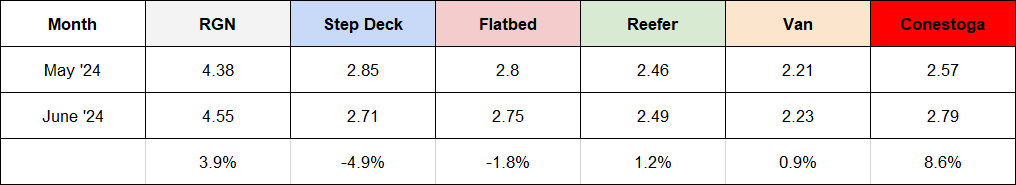

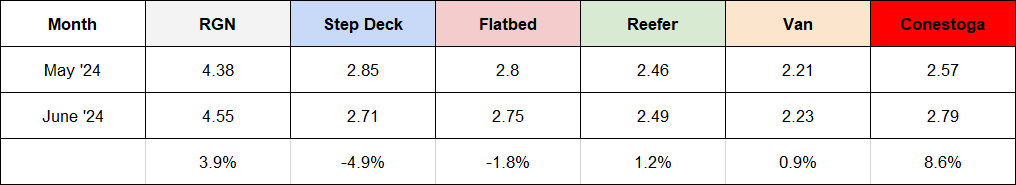

June results

For the second month in a row the largest jump came for refrigerated freight, up three cents per mile on the spot market. Van freight once again only moved up two cents per mile, while flatbed freight slipped five cents per mile lower. Margins tightened – which is an indicator of a market that continues to shed excessive capacity – albeit slowly.

June should be a peak month for flatbed freight. Yet results were mixed. This may be a sign that infrastructure related activity is starting to wane or it may be due to slipping production in the oil fields which increasingly look to have hit peak production and are now just 'holding' without any large, new activity coming onstream in the 2nd half of 2024.

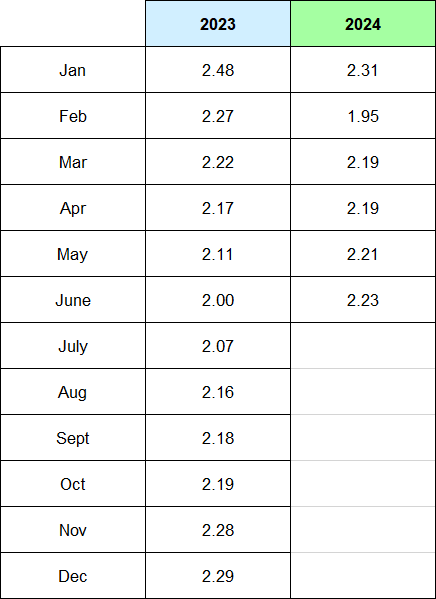

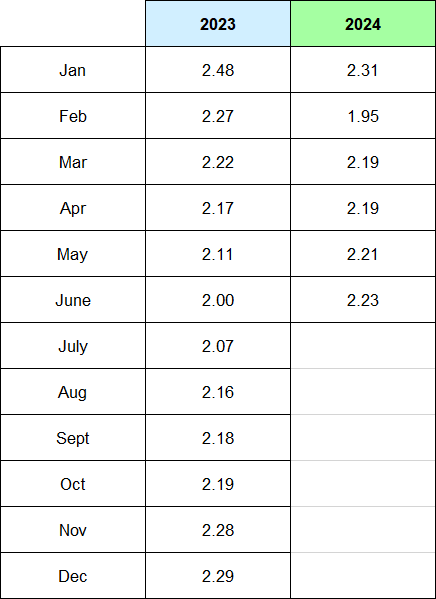

Focus on Van Rates

For the second straight month van freight showed a two cent per mile increase. Since the disastrous month of February, the Transport Pro database shows van rates climbing twenty-eight cents per mile. Having a consistent result reinforces that those super low rates are in the past, yet rates need to go still higher to make most carriers profitable.

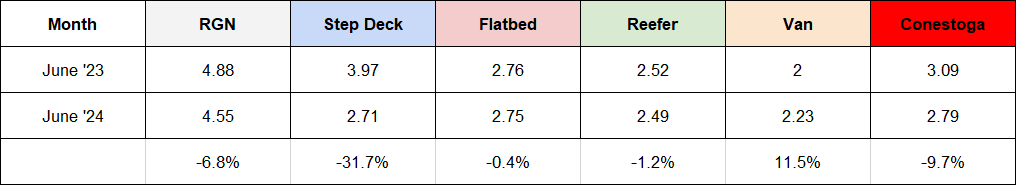

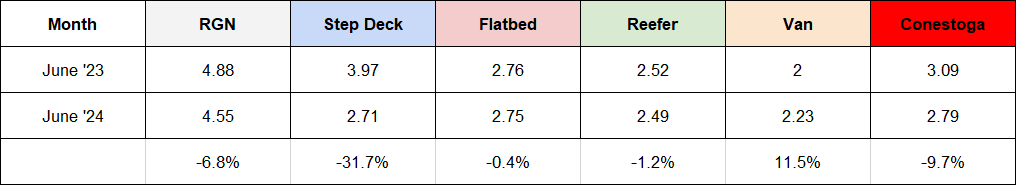

Year-Over-Year Comparison

This picture is actually kind of ugly. Other than van freight, rates really haven’t improved for carriers versus levels seen one year ago. Flatbed rates are about the same and refrigerated freight is only down 1.2% but specialty freight has taken major hits from being a “safe” haven in 2023. It’s hard to make a strong recommendation for a specific equipment type although flatbed (and RGN) continue to be the most profitable.

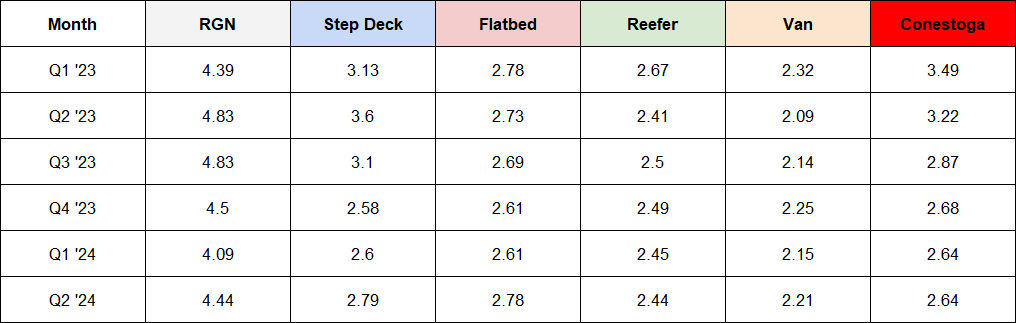

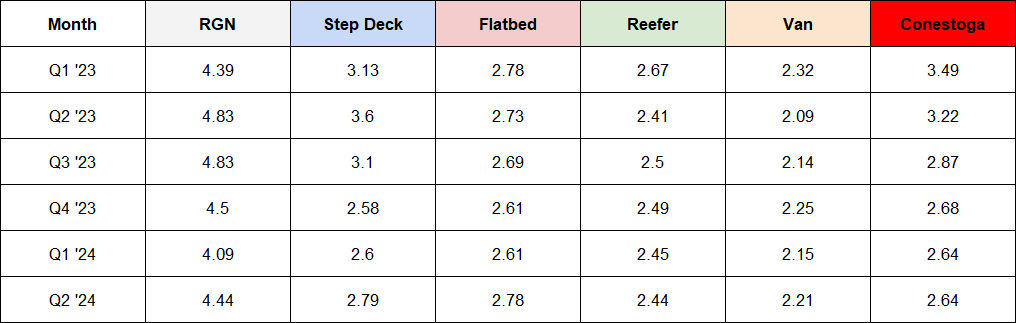

Larger picture - Look by Quarter

Here are quarterly results which provides a different way of looking at sixteen months of data less subject to monthly swings. Again, flatbed has been the most consistent.

QUARTERLY - 2nd Half Outlook

First, the Amazon-powered “Christmas in July” may help van freight hold up in July. Second, the forecast is for a strong hurricane season. Rates have moved out of the doldrums in past years due to the amount of disruption and emergency supplies ordered by FEMA into storm battered regions. Later in the third quarter, hopes are high for the Fed to finally cut interest rates which will provide an immediate boost to the economy. A lot of economic indicators are slowing. This can be seen in the lackluster improvement in June rates for van and reefer and slight decline for flatbed. But inflation may finally approach the target level which would provide some relief to battered consumers. Look for an early report of July data to help you discern which way the markets are breaking this summer.