Van, Reefer Rates Plummet in February

March 01, 2024

The transition from January to February always poses a challenge to freight brokers and spot market truckers. The end of the holiday shopping season which with eCommerce and returns now extends into January, means that economic activity hits its nadir during the month. Also, unseasonably warm weather in much of the US made for the equivalent of increased capacity as fewer delays in shipping were experienced. But one thing became abundantly clear- there is still way more capacity in the trucking spot market than freight.

Rates Crash During February

Months of steady improvement in van rates reversed back to June 2023 levels. In some ways, the bottom resembled the period 2009-2010 as weak markets demonstrated rate levels reminiscent of that period. The change is that costs have increased so that a truckers’ breakeven is closer to $2.30/mile for van freight, meaning that rates are about 15% low. This means that maintenance is postponed and in some cases the owner-operator is forced to sacrifice a good portion of income recognized as wages. Refrigerated truck rates also experienced a sharp decline. Flatbed showed some decline overall yet nothing like the first two modes.

The Results

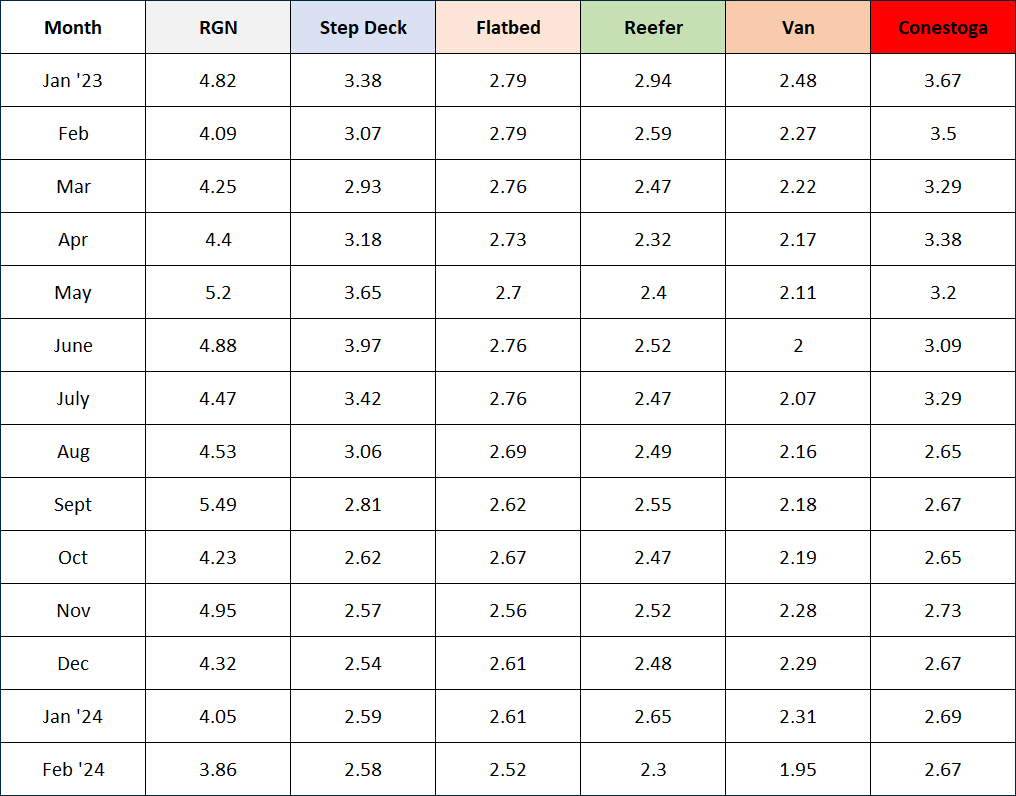

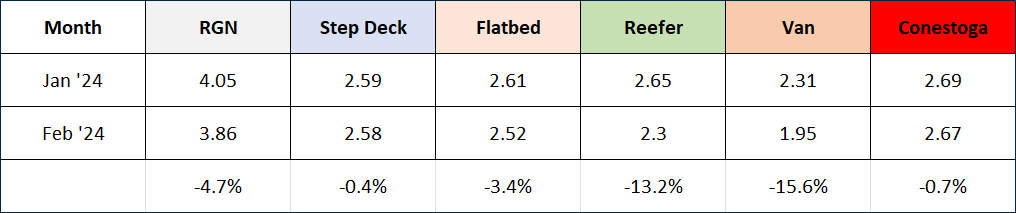

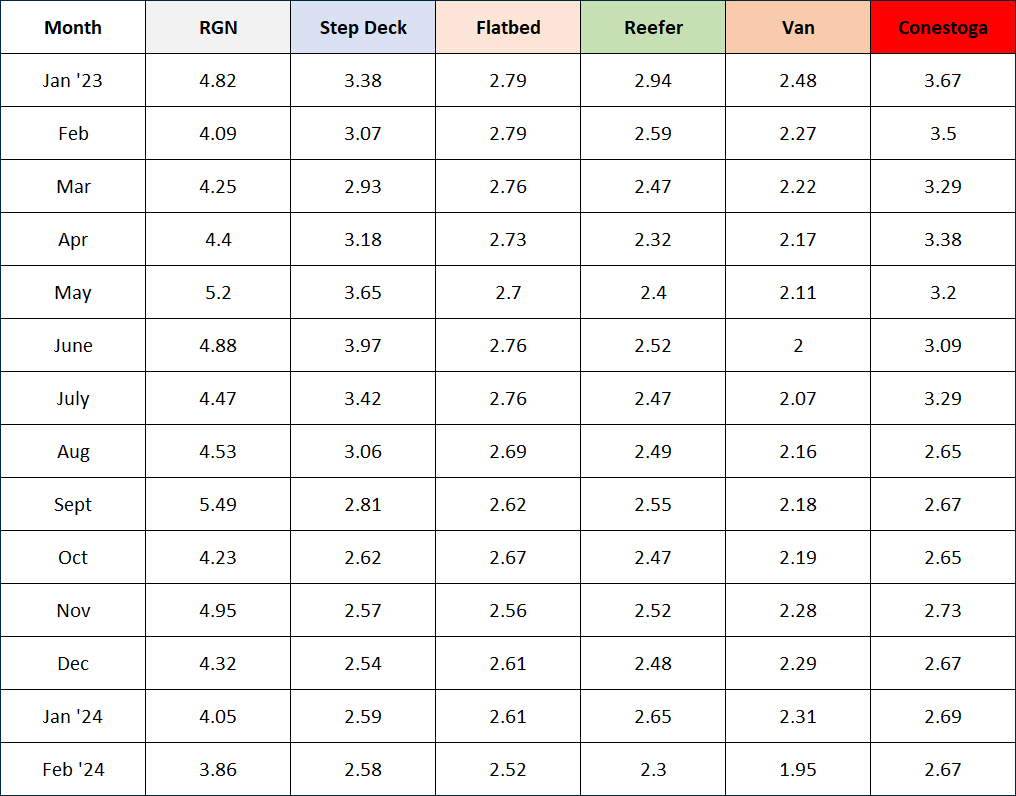

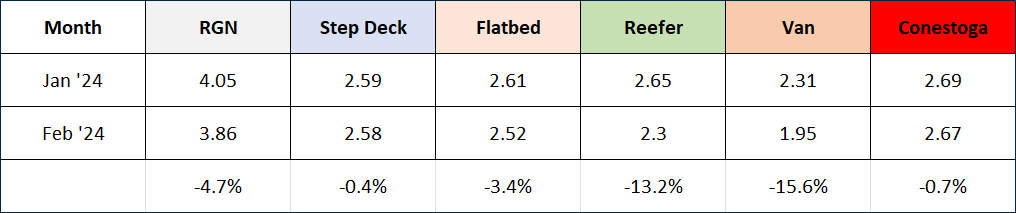

Van rates dropped from $2.31/mile to a national average of $1.95/mile in the Transport Pro database. Broker margins recovered somewhat but it would be fair to say that the recover was uneven. Meanwhile, Reefer rates dropped 35 cents per mile, from $2.65 to $2.30. Interestingly, from January to February of 2023, reefer rates also dropped 35 cents. The probable cause is a weak California shipping market as weather did play a major role in the Golden State. Standard flatbed rates dropped by 3.4% but specialty flats including Step Deck and Conestoga equipment held their rates with less than a 1% drop. Construction activity should have been good with favorable weather which likely helped flatbed equipment avoid the steep price decline seen elsewhere. RGN = Removable Gooseneck Flats, which tend to have volatile rates due to small sample size-

Month-Over-Month

What is the Outlook for March?

March rates generally show improvement from February and it would be hard to contemplate rates worsening. But the first few days may not be any different, which puts enormous pressure on smaller truckers. Shippers are generally unsympathetic and still remember the relatively recent peak rates of 2022. They remain under pressure to cut costs. Meanwhile, brokers are scrambling to regain margins. This writer expects improvement due to seasonality and more truckers deciding to exit the spot marketplace.

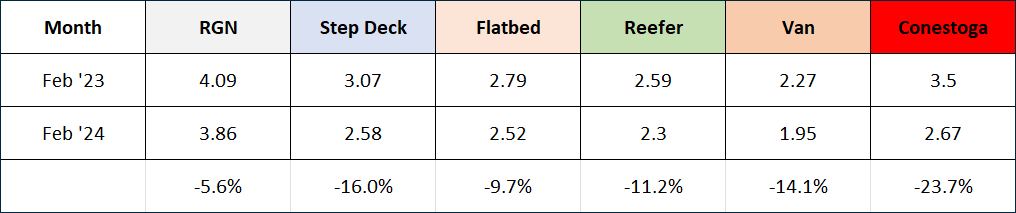

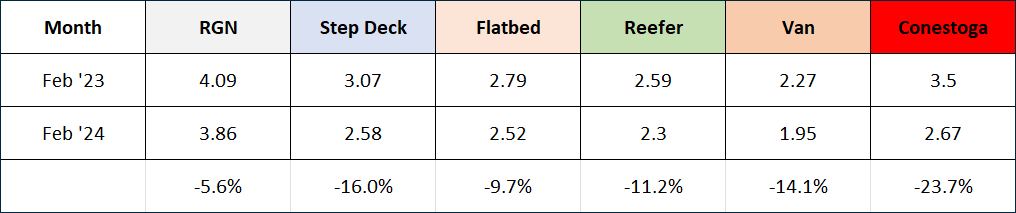

Longer term most economists expect the Fed to cut interest rates perhaps as soon as May. This should pick up the housing market, already applications for housing starts are up. Other key measures of the economy remain solid, as discussed in the prior article. Still, the February data are troubling. A comparison with February of 2023 shows rates are lower by double-digits, including a sharp dip for flatbed. Van rates are down 14% Y-O-Y and reefer is down 11.2%, meanwhile Y-O-Y flatbed rates are lower by 9.7%.

It's possible that the long discussed and feared "Recession" may take place in the first half of 2024. In that case, expect the Fed to move swiftly to cut interest rates. For some small truckers and brokers, it may be too late. Here are the numbers from the Transport Pro monthly files for your consideration-

Year-Over-Year

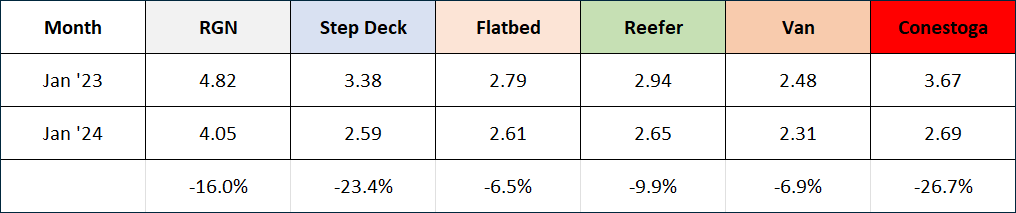

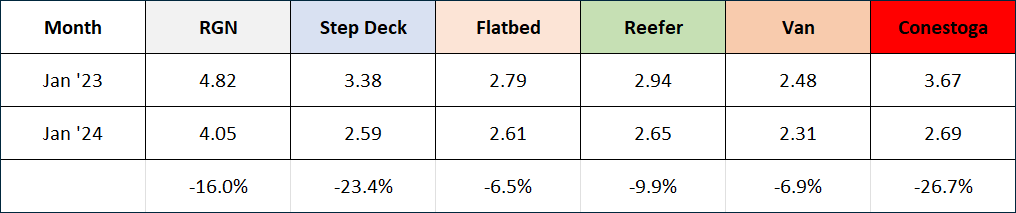

January Comparison

Here is a restatement of the Y-O-Y drop in January numbers. Two straight months with these comparisons has led to much concern in the transportation industry-

Year-Over-Year

Full Recap

The Transport Pro database will continue to be mined for trends to aid in adjusting expectations.

Broker & Owner-Operator (Purchased) 14-Mo. Recap