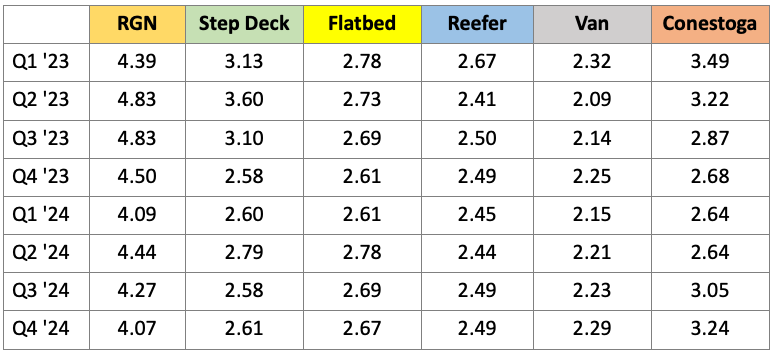

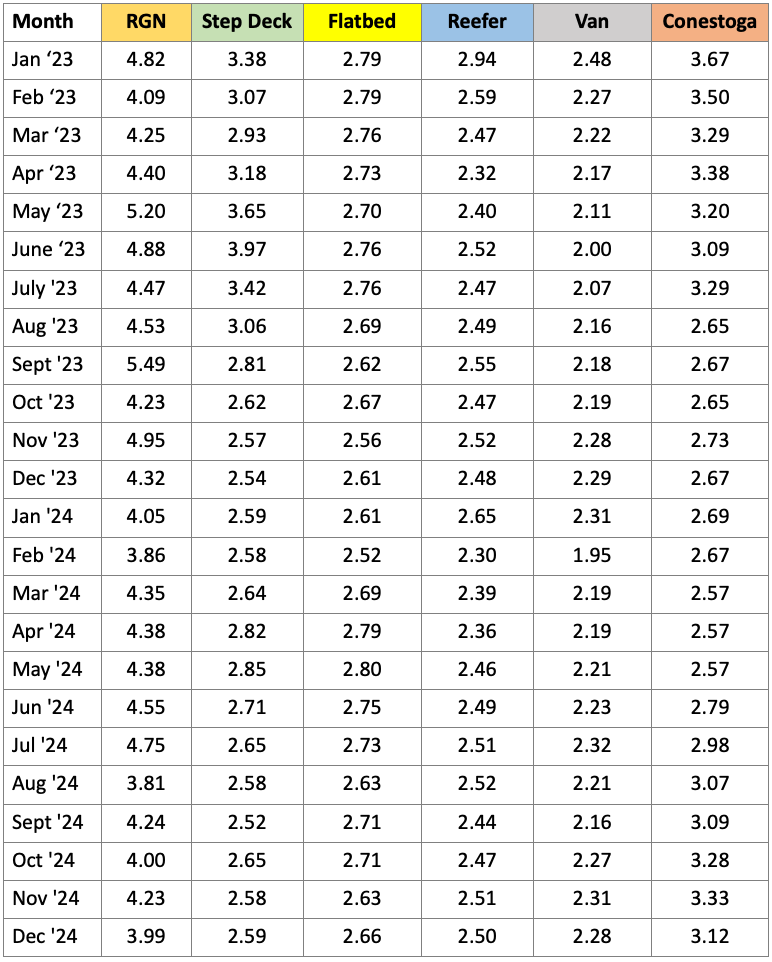

After all the recent ups and downs, the year has ended mostly in the same spot as one year ago. The year started poorly for freight with multi-year lows in February. The summer months showed an improvement vs. historically poor summer numbers in 2023 but the Fall shipping season faltered. This led us to a fourth quarter and final month that rate-wise looks much like the end of 2023.

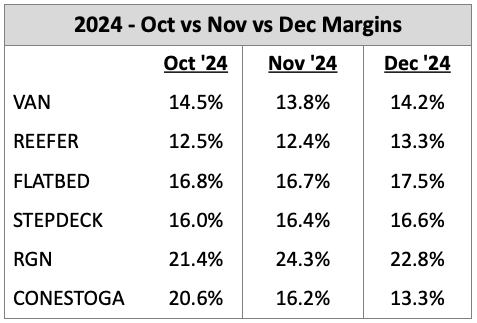

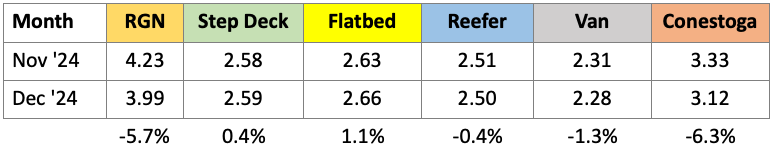

If there is a positive note, it’s that brokerage margins recovered across-the-board in December. Truckers that chose to use factoring also outperformed for December van loads. Here is recent brokerage margin performance measured in the Transport Pro database:

Van rates slipped a few pennies lower while reefer rates dropped just a penny. Flatbed rates are slightly higher. For comparison, factored van rates are up eight cents in December, showing there is a large sector of freight still performing well. Factored loads are vetted which may explain their performance versus regular spot freight.

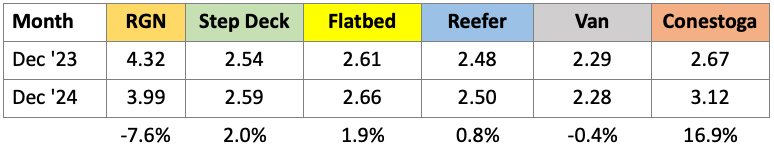

Van rates are the same as one year ago, while reefer and flatbed rates show very small gains. In the context of lower fuel prices vs. higher overall costs, it really depends on the mix of business to judge whether 2024 truckers are better off than 2023. In general there is more optimism among truckers and lower interest rates may be the key factor.

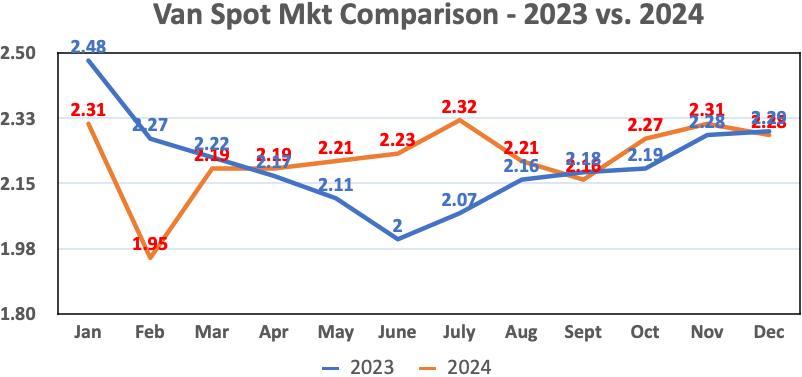

Two different stories in 2023 and 2024 led to pretty much the same ending for van freight.

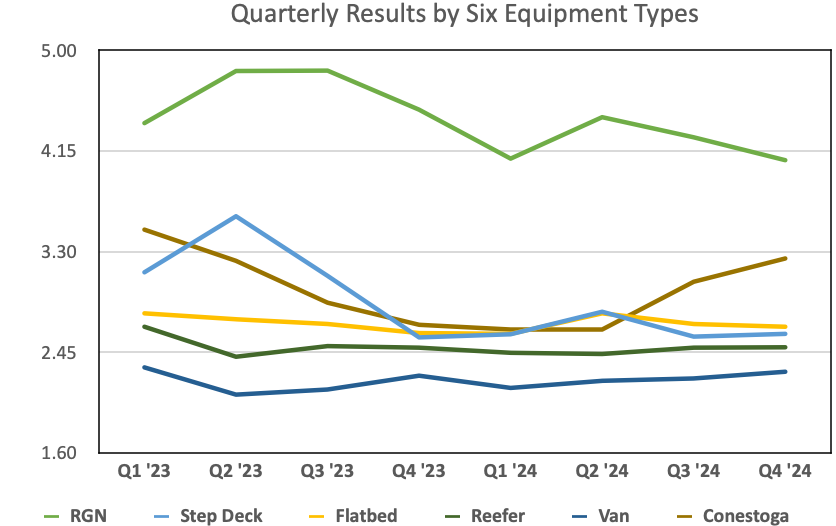

The picture for other freight types is mixed. RGN and Step decks were very popular in early 2023 but declined during the summer of 2023 and remained muted. Van, reefer, and flatbed look more stable in the two year view with monthly changes not creating strong trends.