Six Reasons January 2024 Defied Normal Trends

February 01, 2024

Christmas season ends and normally spot market pricing declines. While rates ended up well below January 2023, there were signs that rates continue to pull out of a prolonged slump. Here are six reasons why trends are bucking traditional results.

Winter Weather Disruption

Winter weather hits hard in January every year. Well, maybe not to the extent seen this past January, which brought the polar vortex deep into the US and included areas like Portland, OR and Seattle, WA into a wintry mix of snow and sleet. Delays due to interstate highway closures slowed deliveries, in effect reducing trucking capacity, which drove up rates, especially for refrigerated equipment. Refrigerated equipment, which can provide heat as well as cooling, saw rates rise 17 cents per mile or 6.9% over December levels.

Falling Capacity

It has been reported elsewhere that increasing number of small trucking companies are closing. While many analysts state that there is still too much capacity in the trucking industry, Transport Pro data show compressed margins. This means that brokers are getting squeezed between the demands of shippers for lower rates and increased willingness of truckers to hold firm on price. Van rates are up twelve cents per mile since October 2023, which is a peak shipping month for the holiday season.

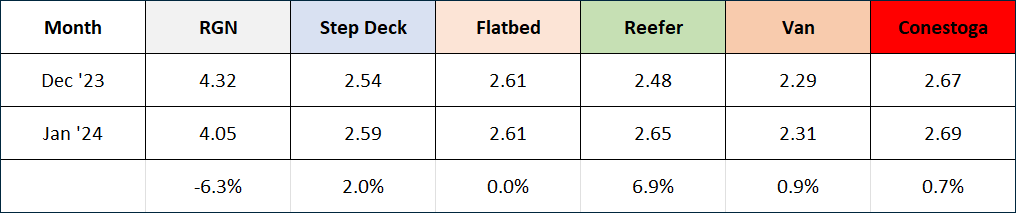

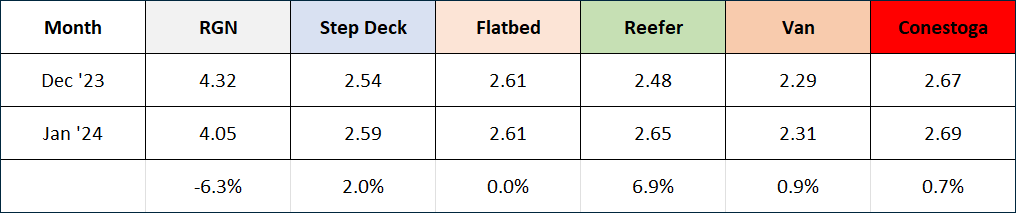

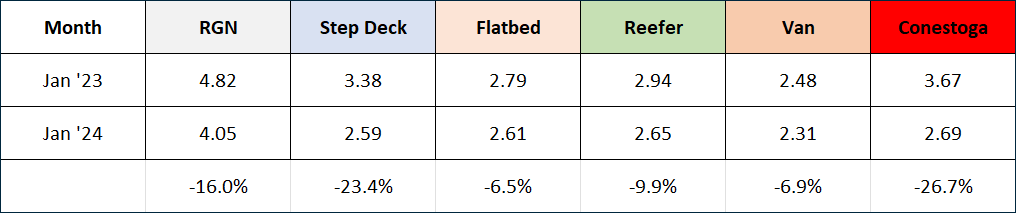

MONTH-OVER-MONTH

Panama Canal Bottle Neck

Ships transiting the Panama Canal find that the journey takes longer. In fact. there is a backlog of multiple weeks. Prolonged drought has impacted the waterway, lowering lake levels, resulting in vessel restrictions. This means that increased amounts of freight will be hitting the US West Coast instead of using the canal. While some of this will result in more rail traffic, there will be a spill over to the spot market. This long-haul freight helps use up excess capacity as trucks divert from shorter haul markets.

Strong LTL Pricing Marketplace

The Yellow Freight bankruptcy and closure did not add a whole lot of business to other carriers. But it was enough to solidify pricing. With the spill over from parcel carriers who continue to thrive from eCommerce demand, LTL carriers remain in a good position to grow volumes. This impacts the breakeven point between LTL and truckload and should further support truckload pricing gains in the near future.

Good/Improving Business Climate

The stock market may be some months ahead of Main Street, with record numbers for the major indices but there is reason for optimism. The jobs market continues to create jobs with unemployment below 4.0%, inflation is falling, and the demand for goods and services remains strong. Almost too strong, as an interest rate cut is badly needed but may be delayed beyond the May target that many analysts have been predicting. As for the trucking industry, it remains in a recessionary position with rates well below January 2023. The point of this article is that rates are building towards higher levels, but there is still a large gap from rates in 2022.

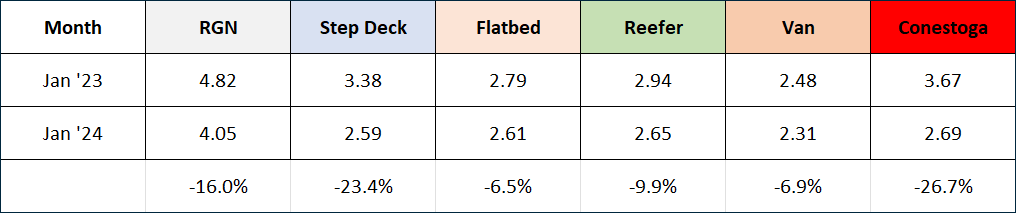

YEAR-OVER-YEAR

Business Inventories Still in a Low Position

Compared to historical levels, inventories are still low, which means any disruption to supply chains can result in shortages. One of those events is currently happening on the other side of the world with the Houthis firing missiles and overall disrupting sea traffic in the Red Sea which feeds the Suez Canal. Alternative sea routes take much longer to reach the US East Coast. When inventories are tight, there is more demand for premium transportation.

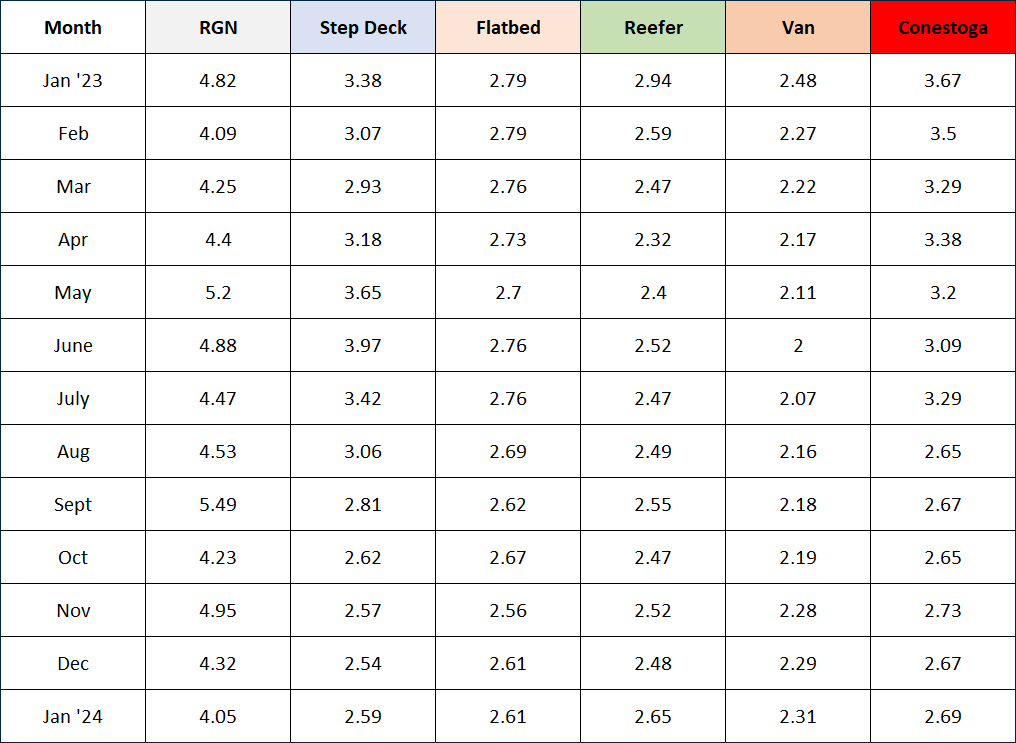

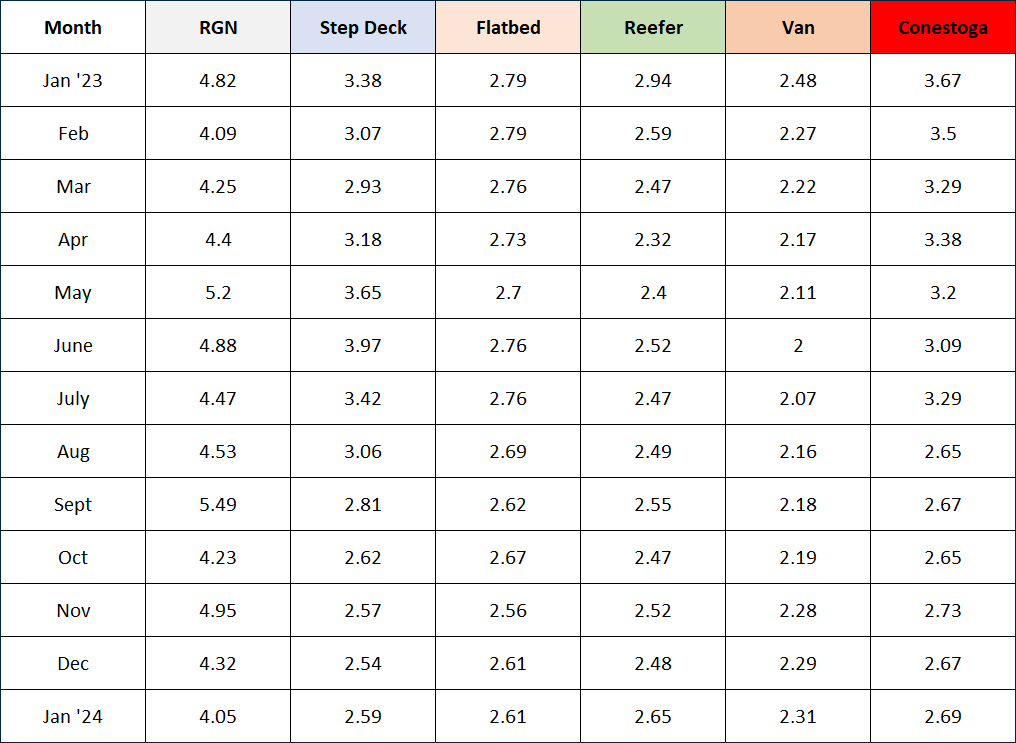

When spring freight levels return, the above factors will mostly persist. The Transport Pro database will continue to be mined for trends in order to verify or adjust expectations. While trucking rates remain well below last year at this time, it’s good to look at these trends to plan costs for 2024. Here is the past thirteen months of Transport Pro data for the top six categories

Broker & Owner-Operator (Purchased) Annual Recap

Rates are all-inclusive (include any applicable fuel surcharges)