Several Signs of Stabilizing Rates

August 01, 2023

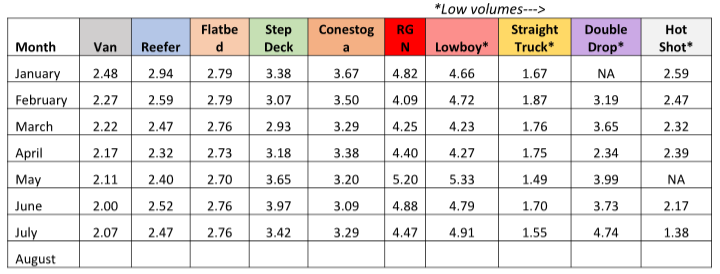

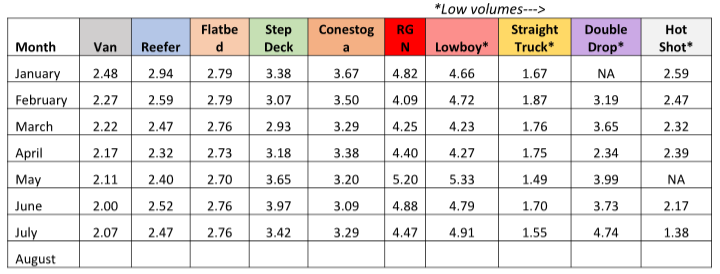

A recent analysis of Transport Pro data from January 2023 through July revealed that the Dry Van market has had a rough time this year. In fact, the high-water mark for rates small carrier fleets and owner-operators received from brokers came in January with steadily falling rates until July. Even then the July increase, from $2.00/mile in June to $2.07/mile represents the second lowest monthly rate for van shipments in 2023.

The positive take away is that van rates generally fall from June, a peak month in years past, to July. Also, broker margins tightened from 18.5% in June to 15.9% in July, showing that excess capacity is leaving the marketplace, forcing brokers to pay a higher percentage of the loads overall pay to secure equipment.

There are a couple reasons why van pricing may be stabilizing and looks to increase in the Fall shipping season. First, the Yellow Freight bankruptcy results in higher pricing in the LTL sector which changes the breakeven point between LTL and truckload shipping. A lot of small carriers have closed-up throughout 2023 but the sudden impact of a major LTL carrier shutting down carries significant weight in altering expectations. Secondly, inventory rebalancing is more or less complete with companies having significantly less inventory to draw and needing a steadier stream from the supply chain. This is offset somewhat from greater confidence in the ability to source equipment and get supply from manufacturers.

Meanwhile, the Transport Pro data shows much different trends in the reefer and flatbed sector. Reefer rates hit their low point in April at $2.32/mile and then rose to $2.52 in June, a modest early summer peak. Flatbed rates have been relatively stable between $2.70 and $2.79/mile throughout 2023. These rates are for all trips over 250 miles and include fuel surcharge where applicable.

The depth of detail in the Transport Pro dataset made it possible to look at other specialty equipment types. These include Step Deck, Conestoga, Removable Gooseneck (RGN) flats, Lowboy and Double Drops. The consensus view of these rates shows strong demand as the rebuilding of the nation’s highways and bridges as funded in the Bipartisan Infrastructure bill continues.

Meanwhile, oil production and projects in the Permian Basin of West Texas and New Mexico continues to push US oil production higher. However, the Baker-Hughes oil rig report shows 129 fewer rigs in operation than one year ago so the picture remains mixed in that sector. Finally, Straight Truck and Hot Shot rates were calculated. These rates show some correlation with van rates.

The overall take-away is that 2023 has been a dismal year for the trucking industry and for most US manufacturing. However, the more recent data suggest plateauing of the numbers with higher Fall shipping season numbers expected to reverse trends. Many headwinds remain so a full recovery should not be expected until well into 2024.

2023 Monthly Rates by Category- Broker to Carrier Pay & Owner-Operator Pay

Notes

Notes

Rates include fuel surcharge, where applicable. Rates are paid to Carrier by Brokers.

Trips over 250 miles only

Specialized, over dimension, overweight, hazmat, LTL moves removed

Each month based upon about 40,000 monthly moves; Van, reefer, flatbed make up 95% of shipments

Flatbed consists of 53' standard deck shipments; specialty flatbed equipment reported

separately