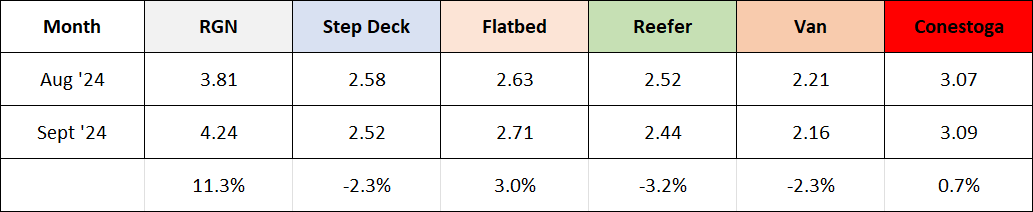

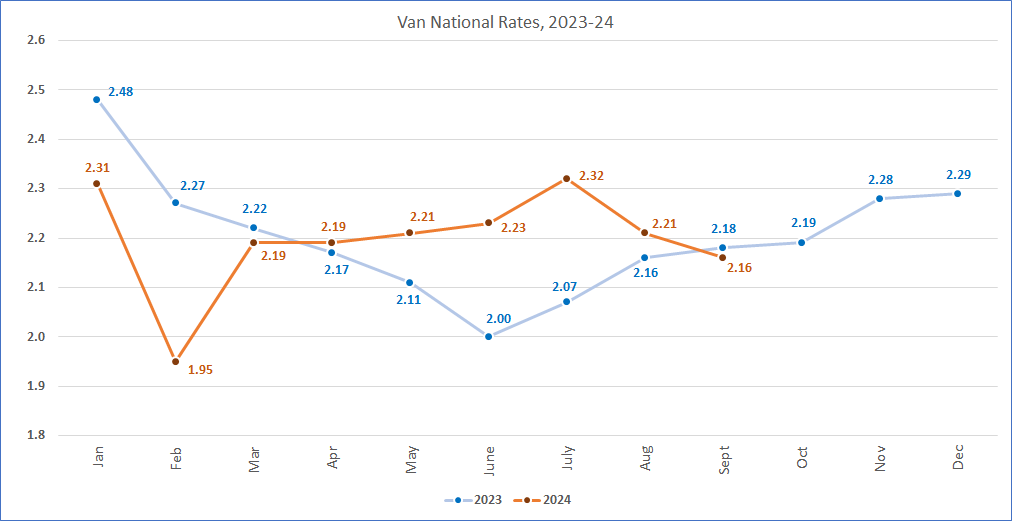

Van and reefer rates on the spot market took a step back in September. This suggests a recessionary trend in the freight marketplace because it is so rare. Brokerage margins continue to be depressed although with a slight uptick. The average margin on van freight was measured at 14.0%, below the normal margins from 2010-2019. Flatbed freight showed more resilience with an uptick from August.

Specialty equipment had a few bright spots. Conestoga equipment continues to be priced above $3.00/mile at $3.09, which is good for carriers. Brokers earn above a 20% margin on this segment. RGN equipment rates bounced back to $4.24/mile, below peak summer rates but not bad for early Fall.

Van rates fell for the second consecutive month. The drop was a significant five cents per mile, from $2.21 to $2.16 or -2.3%. Reefer rates ran parallel, falling eight cents per mile to $2.44/mile, which is -3.2%. Both van and reefer rates typically trend higher in September. There is some data suggesting that contract rates firmed in the month, likely contract capacity keep loads out of the spot market.

Flatbed rates did rise 3.0% erasing the August dip. Margins on this segment remain intact as well at 16.7%. The RGN rates are based on only 89 loads compared to thousands for van, reefer, step deck and flatbed.

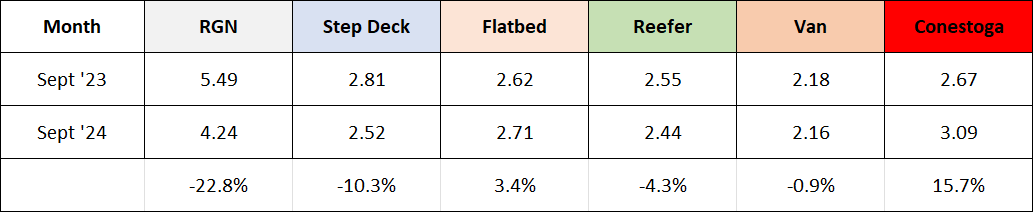

Flatbed shows a modest 3.4% increase from the comparable month in 2023. Otherwise, the news isn’t good. Van is just 0.9% lower but cost increases are well documented versus last year. Refrigerated rates at eleven cents lower hits that segment hard. One year ago, rates rose six cents per mile from August to September.

What about specialty flatbed equipment? RGN and Step deck are below 2023 levels by double digits. But Conestoga equipment appears to be in vogue, with a 15.7% gain versus 2023 and holding at this level for the second consecutive month. For margins, Hotshots earn 24% as measured by 139 loads.

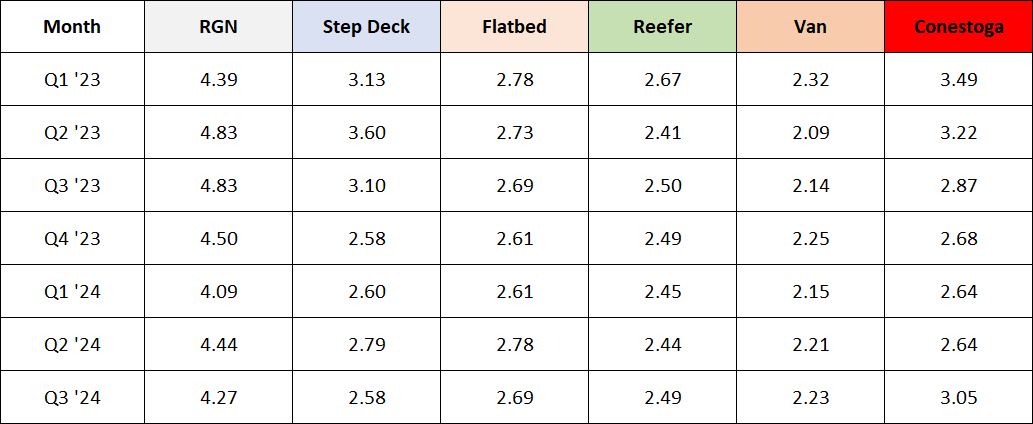

The full third quarter of 2024 is now available. Flatbed and reefer pricing are surprisingly close to 2023 levels, while van overall has gained but the van trajectory is down the past two months.

Nothing in the data suggests a turnaround in the near term. Federal legislation to assist the economy is unlikely until deep into 2025, so that leaves it pretty much up to the consumer. At least the election date passing should provide some added certainty on future policies,

September is NOT always better than August. At least not in 2024. Positives continue in the output of oil and continued low unemployment numbers but more and more cracks have occurred. The Fed cutting interest rates doesn’t hurt but it’s questionable how much it will help an ailing freight economy.

Hurricane Helene is the wild card. Decreased economic output from the area will be counter-balanced by emergency aid flowing into the Southeast region. This natural disaster took proportions that are difficult to fathom, with a large loss of life and property. Transport Pro and its partners join in hopes for a recovery and the reuniting of families displaced by the storm. Natural disasters are where the spot market really steps up. That story has yet to be told.