Mixed Results Close Out September & 3rd Quarter

October 12, 2023

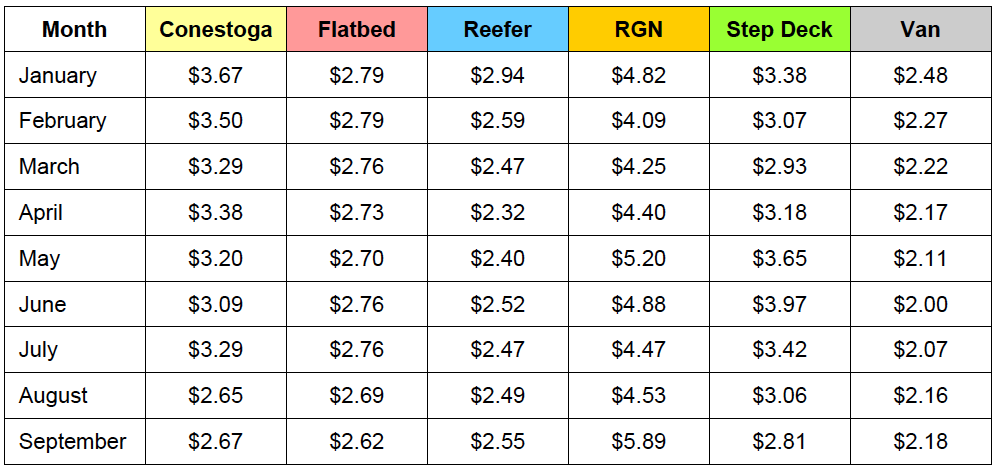

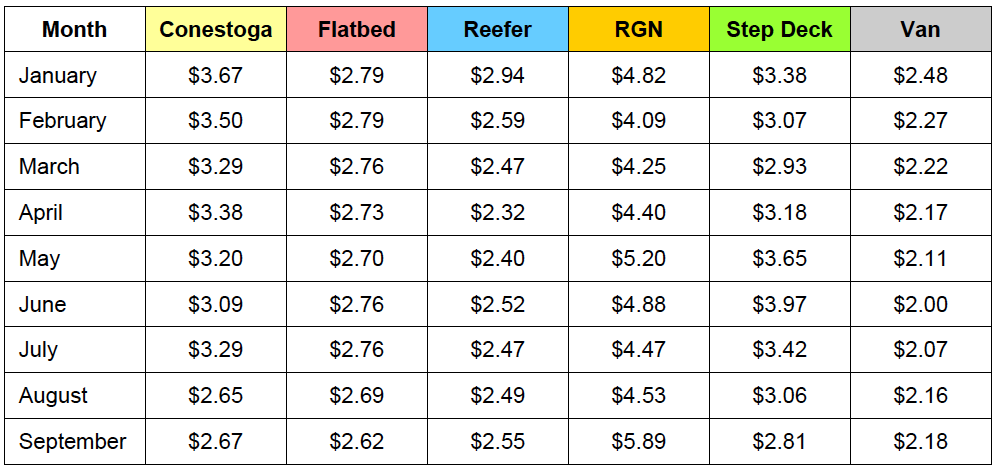

Analysis of Transport Pro database for the month of September shows improving metrics for refrigerated freight, very slight improvement for van, and seasonal declines for flatbed freight. The freight marketplace has been in recession during 2023 so any signs of historic trends is welcome news. An added plus for carriers is that fuel prices moderated with some declines at the end-of-month and beginning of October.

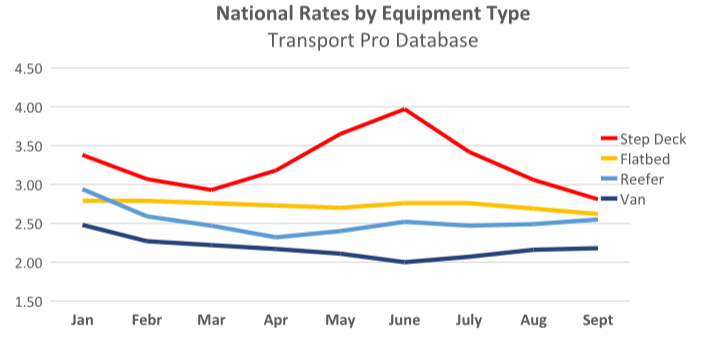

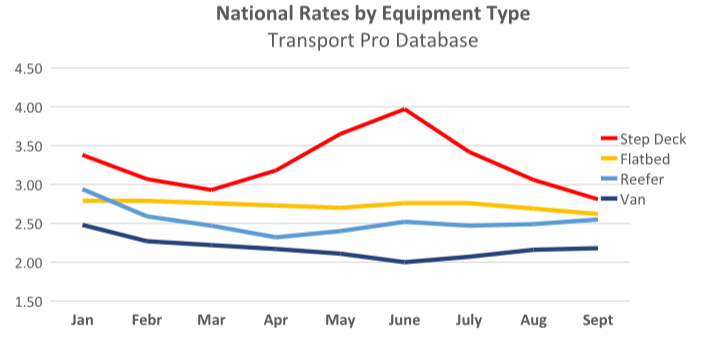

Historically, the 3rd quarter close of business has been one of the strongest periods for freight volumes, with tightening capacity. This year rate changes were modest but still significant enough to negatively impact broker margins. Partly that may be due to an exit of capacity due to the ongoing difficult conditions for truckers. The one bright spot for carriers of strong demand for specially flatbed equipment dropped off precipitously since June as shown in the graph below. Flatbed rates are plotted separately for Step Deck and standard 53’ flatbed equipment.

Brokerage margins slip

Overall, broker margins slipped from 16.1% to 15.5%. Volumes appear to be off for the September quarterly close. Likely the start of the UAW strike has already impacted freight levels but there are plenty of other factors including fewer oil wells being drilled and lackluster consumer demand.

The refrigerated sector has not seen the typical peaks of the Back-to-School plus Halloween push, and reefer equipment remains plentiful on produce lanes (USDA Truck Report). Still, broker margins took a small hit for that segment, falling from 14.2% to 13.8%. Reefer rates rose six cents per mile from August to September, consistent with the tighter margins.

Summary

The good news is that the eCommerce era means an expectation of strong van demand through the end of the year. Headwinds remain of higher interest rates and the ongoing UAW strike. And then there is the War between Israel and Hamas, which could lead to greater involvement in the Arab sphere and higher fuel prices if supply is reduced from the Middle East. Look for continued reporting of results from the Transport Pro database to assist in understanding national freight trends.

Rates include fuel surcharge, where applicable. Rates are paid to Carrier by Brokers.

Rates include fuel surcharge, where applicable. Rates are paid to Carrier by Brokers.

Notes

Trips over 250 miles only

Over dimension, overweight, hazmat, LTL moves removed

Each month based upon about 40,000 monthly moves; Van, reefer, flatbed make up 95% of shipments

Flatbed consists of 53' standard deck shipments; specialty flatbed equipment reported separately