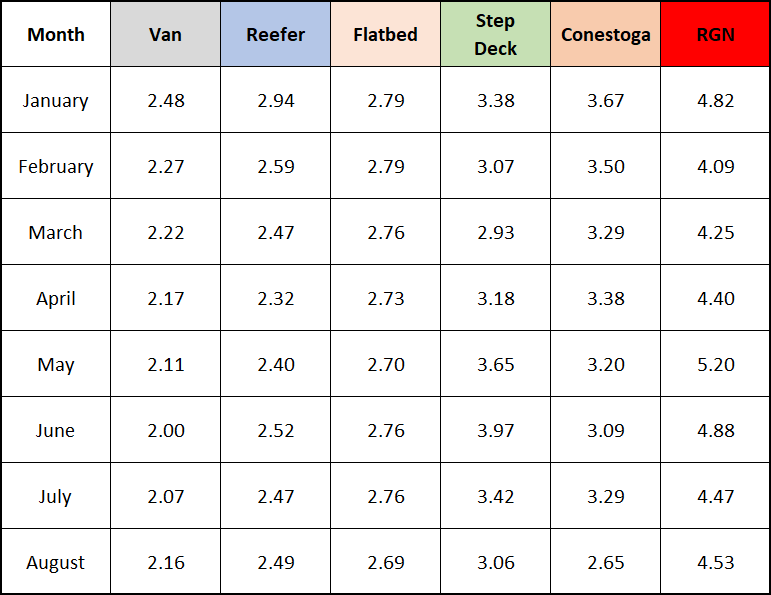

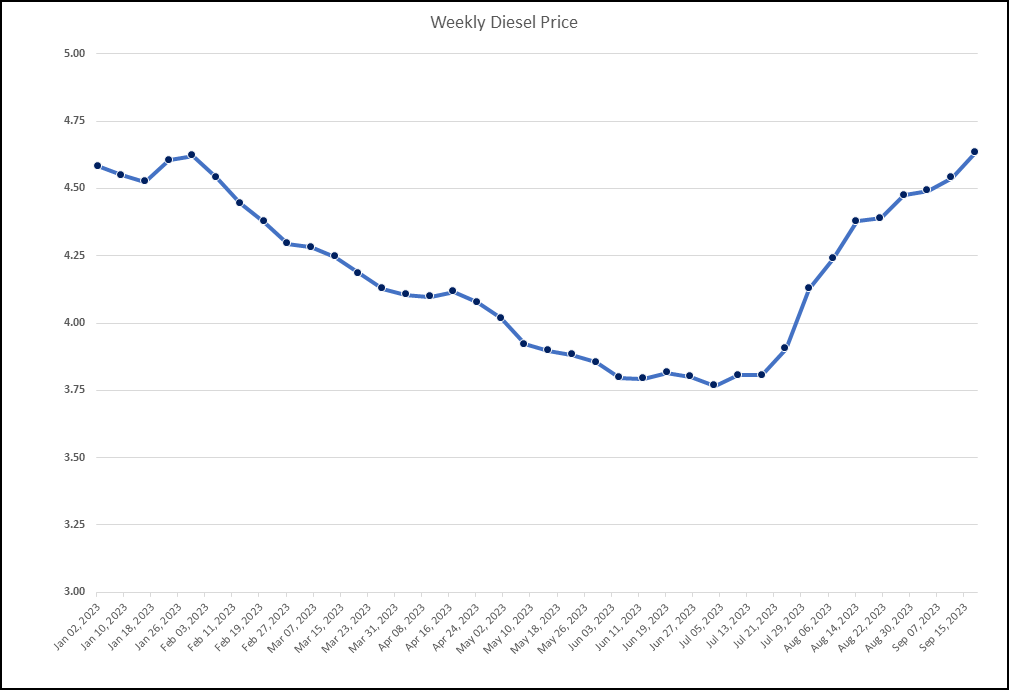

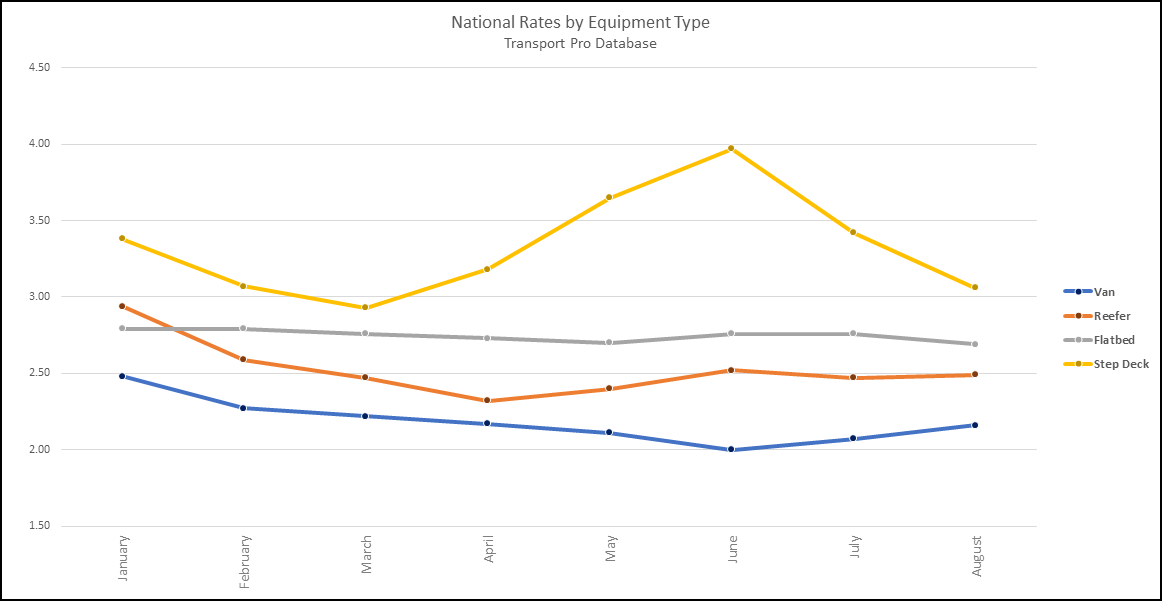

Stronger van pricing occurred in the Transport Pro database as rates rose from $2.07/mile in July to $2.16/mile in August. In other sectors, reefer pricing showed little change and flatbed pricing slipped seven cents per mile lower. The rate story dismays small truckers and owner-operators because diesel fuel prices rose $0.827 from July 17th to September 18th per the weekly DOE tracking website. At 6.4 mpg that diesel fuel increase calculates to 12.9 cents per mile. A more efficient truck at 7.5 mpg still pays an additional 11.0 cents per mile. Due to the fuel increase most truckers ended August in a worsening position.

Larger fleets can negotiate fuel surcharges with their major shippers; hence they are more insulated from a rapid run up in fuel prices. Spot market carriers have their rates set by the marketplace so the supply and demand equations outweigh cost changes for fuel and other items subject to inflation.

Earlier in the summer flatbed rates showed more resilience, even as van rates were falling. June showed particular strength in specialty flatbed types; the Transport Pro database allows tracking of Step Deck, Conestoga, and Removable Gooseneck (RGN) flats. These peaked at various times in the Spring season with Step Deck hitting its peak in June at $3.97/mile. In limited data transactions, that number has fallen to $3.07/mile in August.

A Brokerage Perspective

Plenty of capacity and soft rates may be welcome from the tight capacity of prior years. It also may mean that competition for loads has increased and shippers may feel less compelled to pay top rates with plenty of choices. Based on about 40,000 monthly transactions, brokerage margins have been compiled from the Transport Pro data base for 2023.

Historically brokerage margins have been mostly climbing in the past dozen years. While individual transactions can range from negative to 30% or higher in a few instances, generally margins have been sitting between 15 and 18%. In June, the brokerage margin hit a high of 18.5% but it dropped in July to 15.9% and stayed down in August at 16.1%.

In prior years, margin compression has occurred with broker margins as low as 13.5%. The challenge with brokerage is to gain market share in order to convert those healthy margins into profits. A competitive marketplace has brought margins down the past two months.

Truckers and Brokers Face Challenge

The Fall typically means a build-up in freight volumes for the holiday shopping season. Hopes for improved volumes face a headwind from the UAW strike, since resolved, and US government threatened shutdown, an ongoing concern. In addition, interest rate increases by the Fed and inflation are cutting into household budgets. These factors mean uncertainty for the freight marketplace.

August reefer rates rose only two cents and are down three cents from a slight June peak. The produce markets appear to be off due to severe heat in many growing regions. The flatbed sector held up better through July. August rates show a drop of seven cents per mile to a national average of $2.69. Given the rapid increase in diesel prices, this equipment class may begin to struggle to maintain profitability.