November Van Rates Continue Rise

December 1, 2023

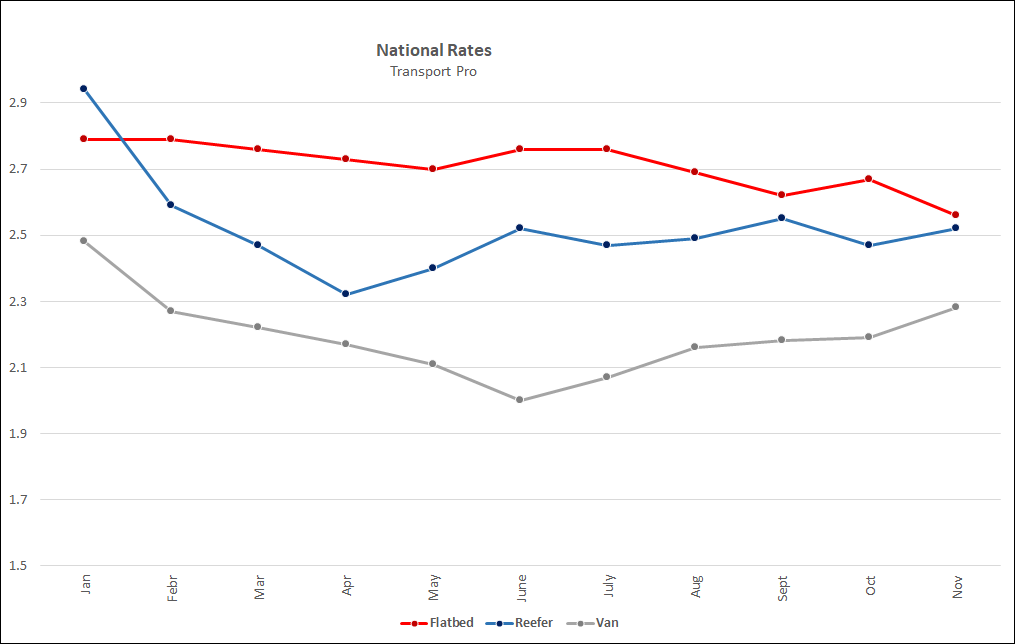

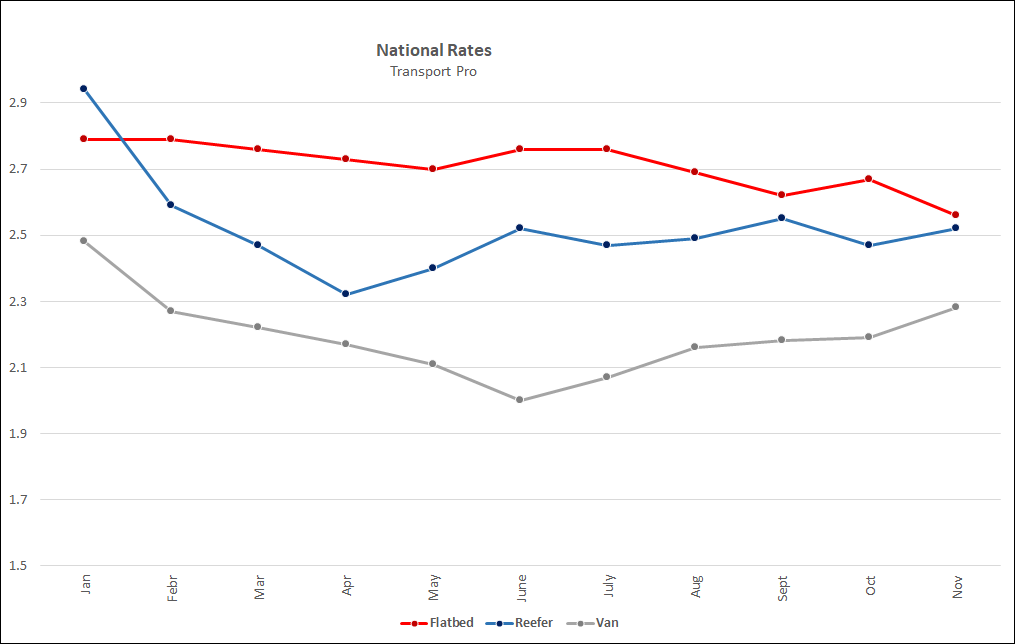

Spot market van rates have been inverted in 2023. Usually there is a June peak, summer slump and a

modest rebound in the Fall shipping season. The Transport Pro database shows that van rates hit a low of

$2.00/mile in the spot market in June but have recovered somewhat since that time, including a surprise

nine cent per mile increase from October to November. Overall van rates have risen twenty-eight cents

since June. Outside data supports this finding as job growth and GDP numbers show an economy that is

holding up despite inflation. Even so, the current benchmark reflects plenty of weak pricing in many

freight markets and broker van margins remain subdued at 13.3%.

Refrigerated trucking rates though have remained mostly flat since June, although falling diesel fuel costs

have helped trucking profitability. Standard deck 53’ flatbed rates have fallen sharply since June, by

thirty cents per mile. The usual delta between refrigerated and standard flatbed rates has been restored.

Messages on trucking internet groups reflect this mixed picture. Many truckers continue to

describe rate conditions as brutal even while others report ongoing profitability through astute

business practices. Recent entrants that experienced the highs of late 2021 and early 2022 are

dropping out of the spot market. Specialty flatbed freight held up through the 2 nd quarter of 2023

but has dropped considerably in the RGN, Step Deck and Conestoga categories tracked within

the Transport Pro database. It does look like the bottom may have been hit in October, as rates

rose for RGN and Conestoga shipments in November on higher volumes of concrete and steel,

likely due to ongoing infrastructure spending, A lot of Step Deck and RGN freight falls in the

over dimension/over weight category and is not reflected in the overall numbers provided.

The forecast for 2024 remains intact, real improvement starting in the 2 nd quarter. There remain a

lot of weak markets and poor paying commodities that are unlikely to turn around in the first

quarter. Some of November’s improvement can be attributed to stronger Christmas/Holiday

sales than expected. As stated earlier, lower diesel fuel prices also are helping stabilize the

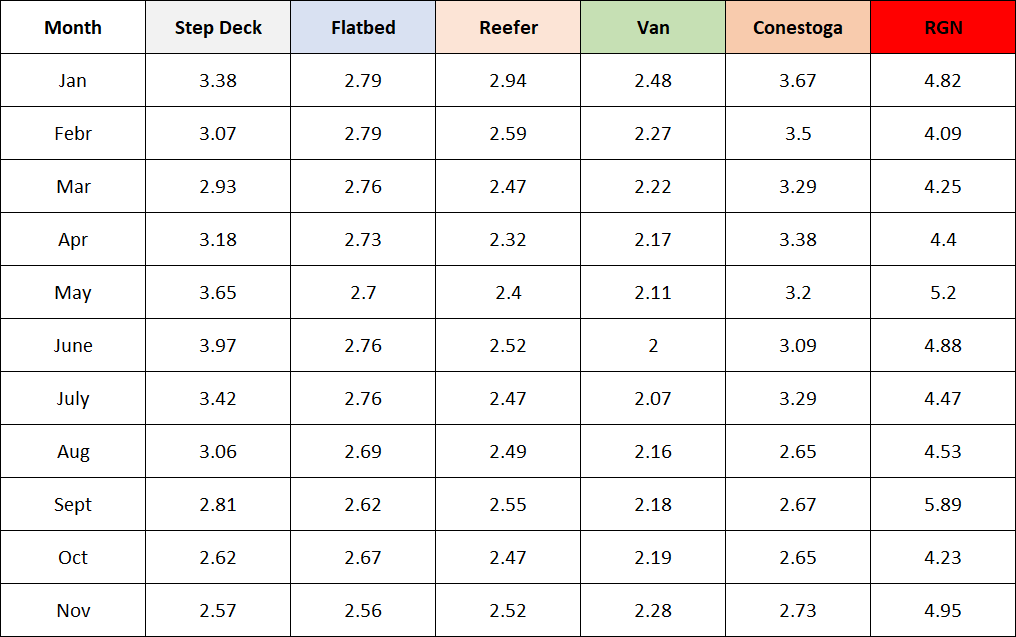

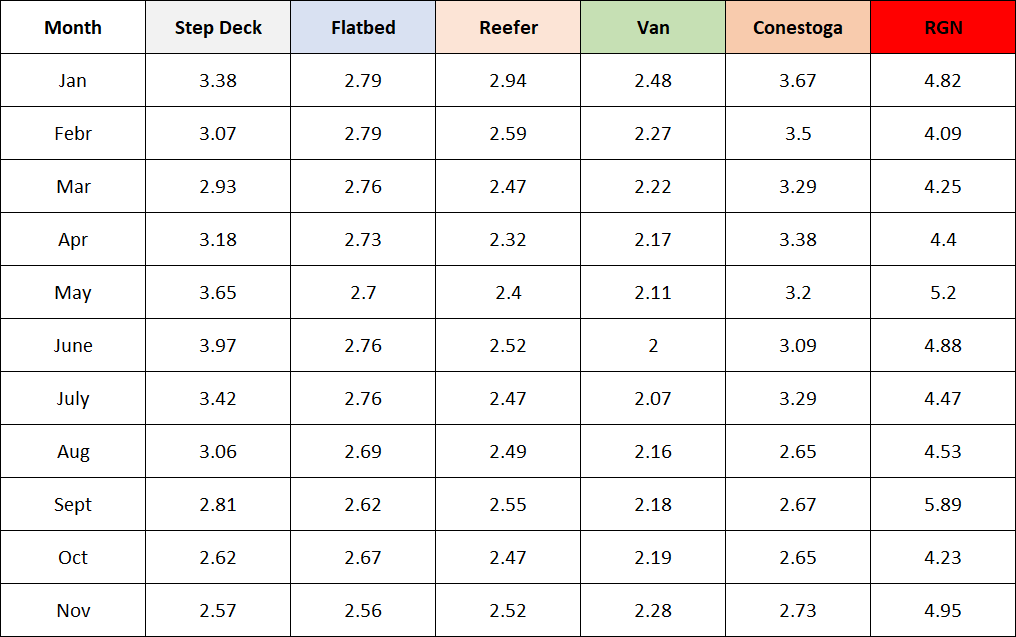

current marketplace but it also helps prolong excess capacity. Here are the numbers for six

categories of equipment

Rates include fuel surcharge, where applicable. Rates are paid to Carrier by Brokers.

Notes

Over dimension, overweight, hazmat, LTL moves removed

Each month based upon about 40,000 monthly moves; Van, reefer, flatbed make up 95% of shipments

Flatbed consists of 53' standard deck shipments; specialty flatbed equipment reported separately (Conestoga, RGN, Step Deck)