May Rate Trends Slightly Better Than One Year Ago

June 1, 2024

Every category of freight either matched April’s level or slightly improved upon it in the latest round of Transport Pro data analyzed. The most general categories of van, reefer, and flatbed rates also exceeded their levels from one year ago. Specialized flatbed freight was not as robust as one year ago however, perhaps as more capacity chased those categories. The improvement is tenuous as pricing issues remain for a number of fleets. That said, clearly some market participants are beginning to find better rates.

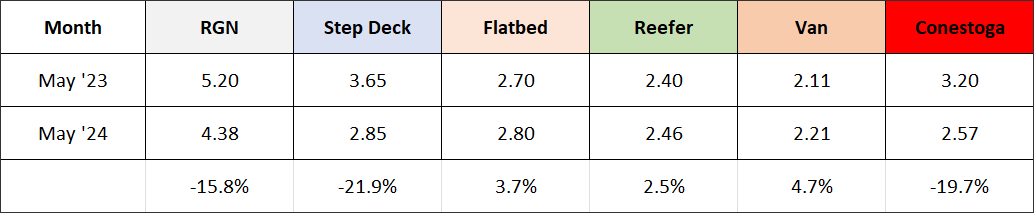

May results

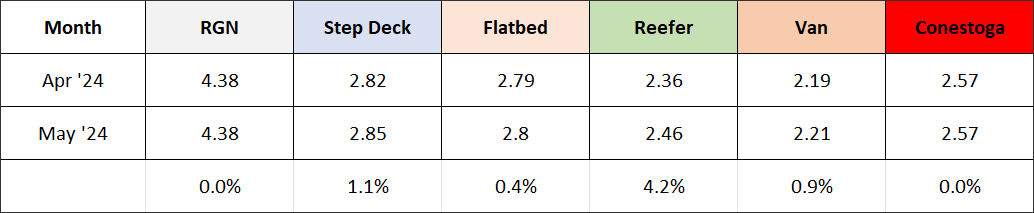

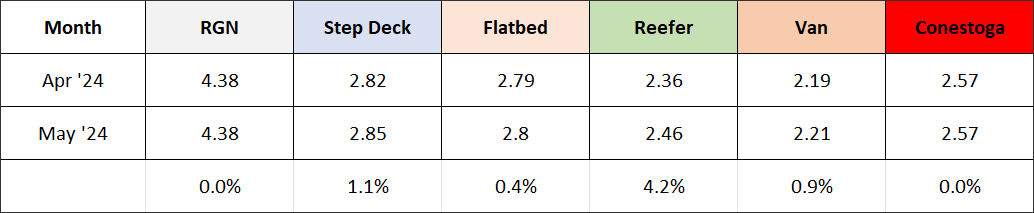

The largest monthly jump came for refrigerated freight, up ten cents per mile. Van freight only moved up two cents per mile, while flatbed freight was just up one penny. Considering the April to May movements of past years, this can be judged disappointing. But considering last year’s performance, it may actually be encouraging that we may see some form of peak season.

May is typically a strong month for flatbed freight. Interestingly, Conestoga and RGN numbers were identical to April’s level. Due to smaller sample sizes, these numbers can be more volatile. Step deck rose three cents or just over 1% while standard 53’ flatbed equipment rose just one cent. On a month-month basis every category either rose or stayed the same, but the increases were not impressive.

Month-Over-Month Comparison

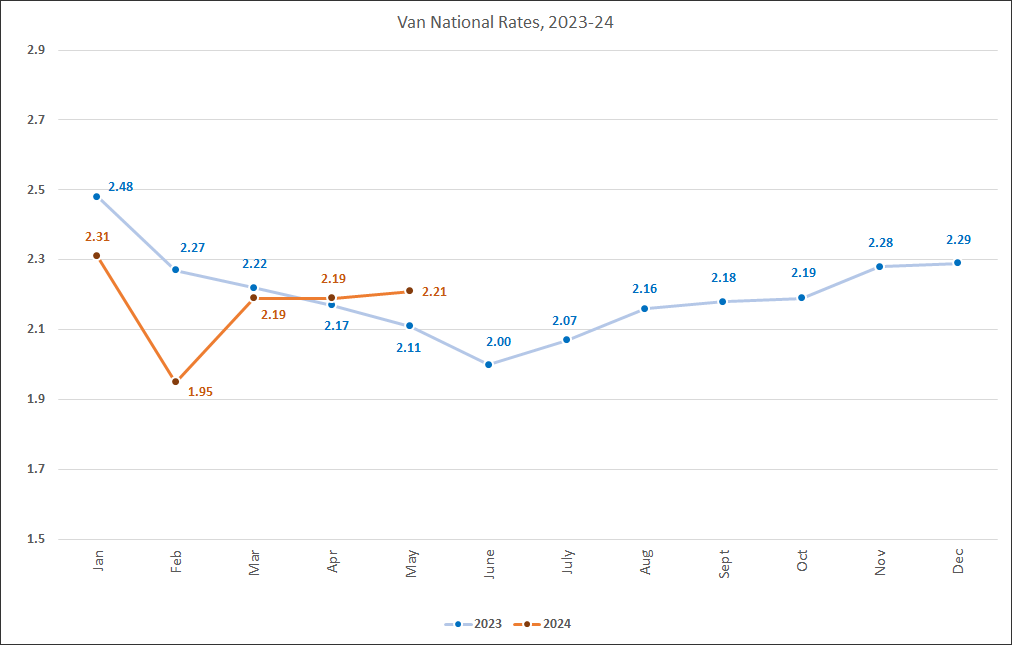

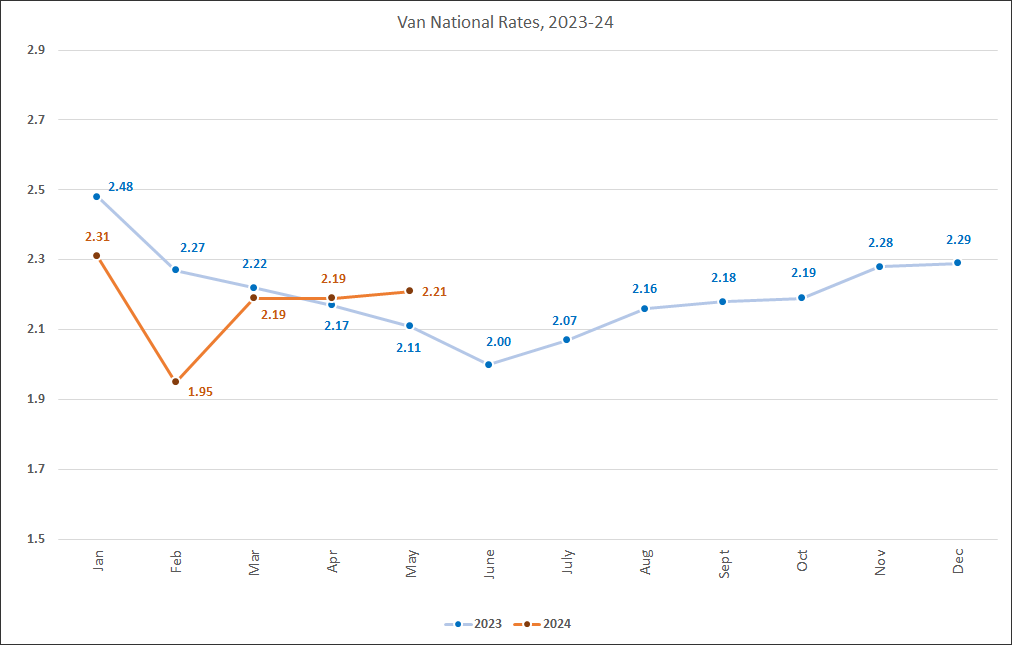

Focus on Van Rates

Prices on van freight exceeded May 2023 by ten cents. This probably represents the strongest metric in this

month’s data as fuel prices have dropped slightly from one year ago. The graph below illustrates how trends

have reversed. Further evidence is provided from van data outside of this database showing similar results.

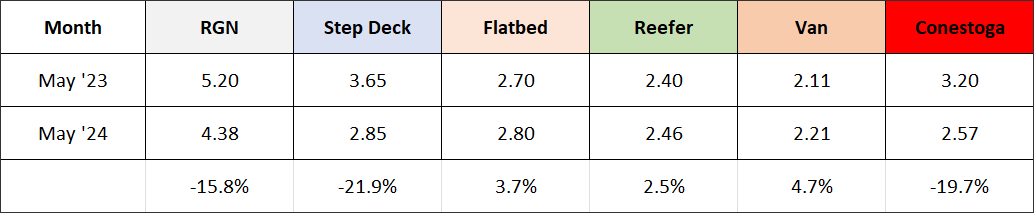

Year-Over-Year Comparison

Standard deck flatbed freight is ten cents higher in May ’24 than in May ’23. Specialty flatbed freight lost

ground, especially for the Step Deck category which is down 36 cents YOY. Conestoga freight had slipped

at the end of last summer. Specialty flatbed became refuge for carriers experiencing poor van and reefer

numbers – now the situation is normalizing with standard flatbed, van, and reefer rising.

Month-Over-Month Comparison

Brokerage margins rose for van and flatbed freight during May. Reefer margins remain challenged but not far out of line for heavy produce shipments which have started for onions and potatoes. The van margin measured at a healthy 16.3% while flatbed margins came in at 20.0%. This is a strong recovery from February numbers which had many midsize brokerages in a panic.

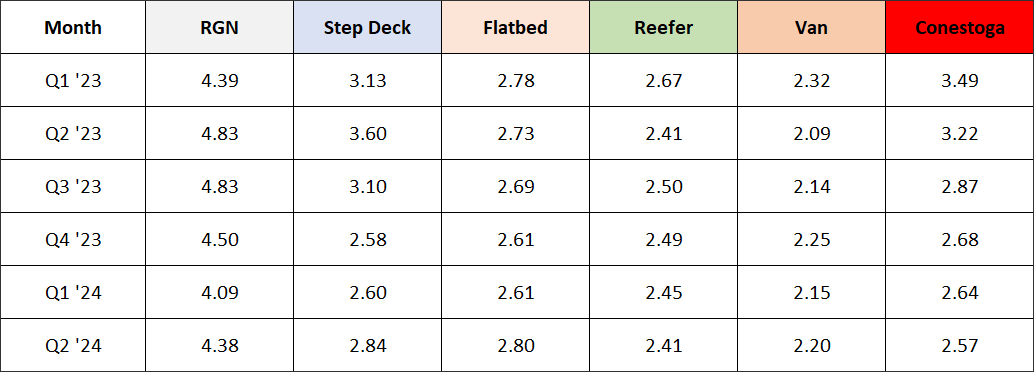

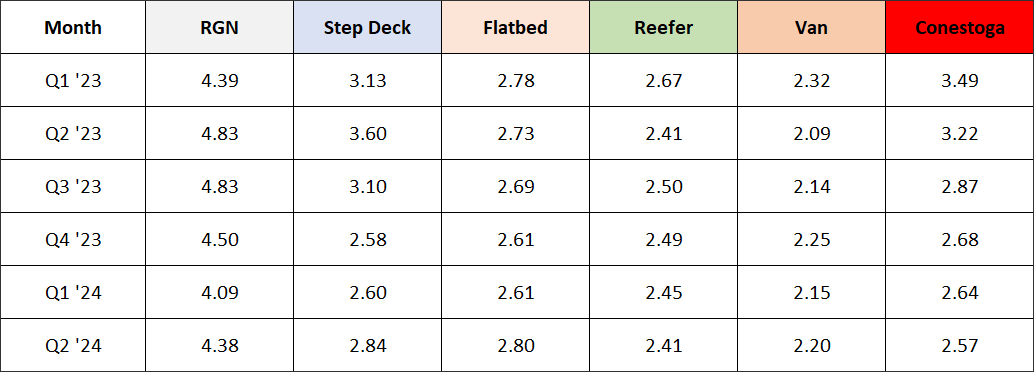

Larger picture - Look by Quarter

Here are quarterly results which provides a different way of looking at sixteen months of data less subject to monthly swings -

June Outlook

Employment is up despite high interest rates and spending is strong. This economy continues to defy those calling for recession. Van brokerage margins recovered from a weak 14.0% to 16.3% showing that top line revenue is able to improve, at least in certain regions. There is little reason to believe that June won’t show improvement in rates. Key economic indicators are mixed but the freight markets are appearing resilient. Oil prices remain relatively tame, below $80/barrel for WTI crude but a recent run up is cause for concern. June outlook is for modest improvement.