Broker margins slipped again in October which should set off some alarms. Carriers are definitely finding the current marketplace challenging. It’s fair to say that the trucking industry is experiencing recessionary conditions despite several economic indicators to the contrary.

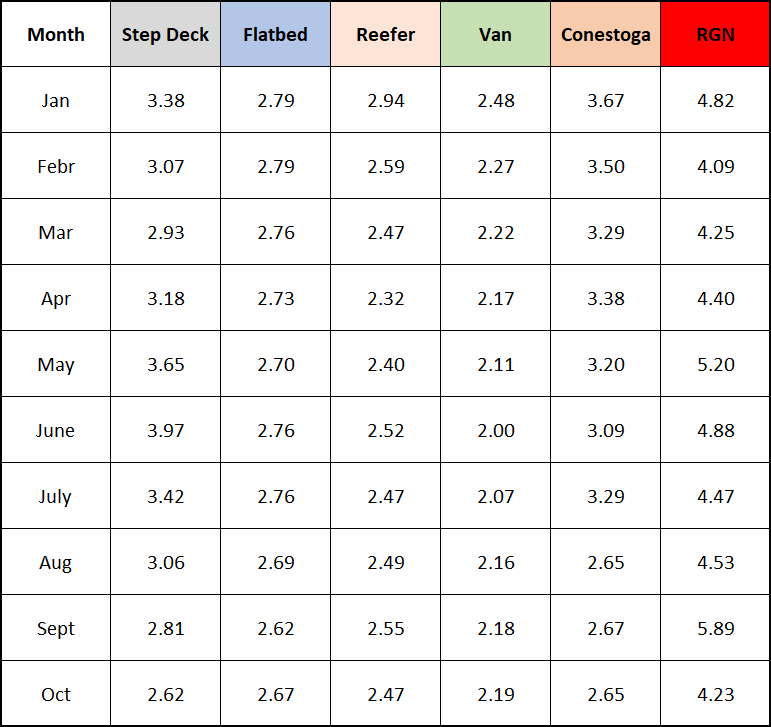

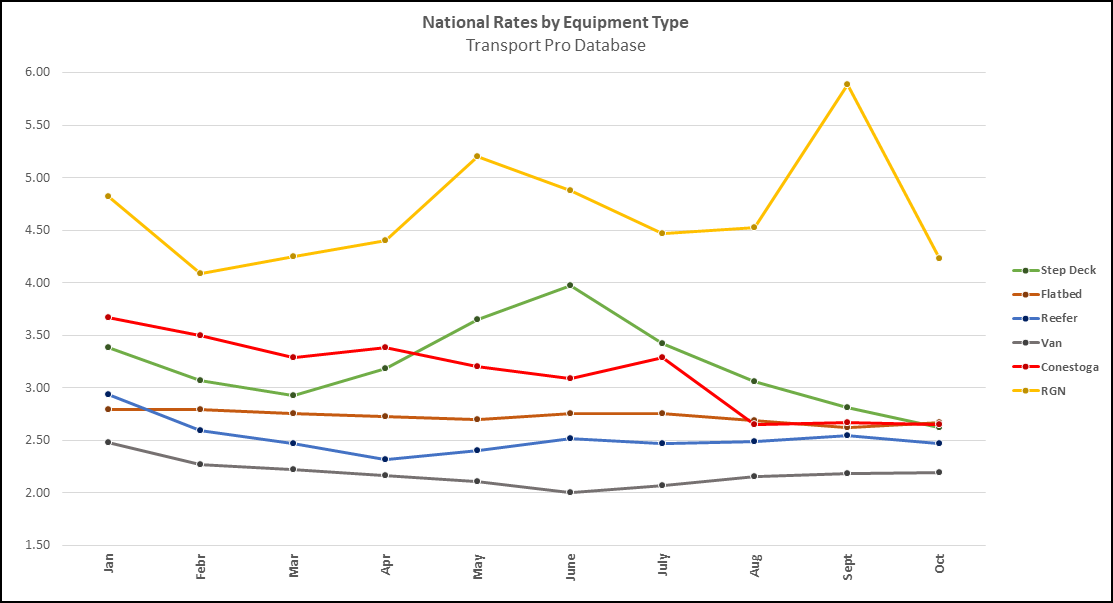

Markets showed little change from September to October especially van spot market rates which only changed by one cent higher. Spot market reefer rates fell by eight cents at the national level as too many areas experienced a subpar harvest, including Mexico, where cross border traffic showed equipment surpluses per the USDA Truck Rate Report.

The one bright spot of 2023 had been specially flatbed freight. These segments fell the sharpest in October, rates for Step Deck equipment declined nineteen cents month-month while RGN rates fell back to Earth as shown on the below graph. There was a positive change in standard deck 53’ equipment, which rose five cents to $2.67/mile, on par with August rates.

The broader economy shows positive GDP growth, positive job growth despite recent slowing, and an unemployment rate generally considered as extremely low. Yet economic conditions remain troubled by rising interest rates, and worrisome inflation, especially in regards to food and housing prices. These combinations of economic conditions are unique. Since the trucking industry deregulated in 1980, there have been several boom-and-bust cycles but none where the freight marketplace was so divergent with general economic conditions.

Meanwhile trucking rates were in freefall earlier in the year, now appear to be stabilizing but broker margins have been shrinking. Spot market van rates are behaving out of character with June being the low point. This turmoil can be attributed to a rapid increase in capacity during 2022, which leads to lower rates as the marketplace adjusts. As that capacity continues to leave the marketplace, there should be a reset, most likely in 2nd quarter of 2024 to more normal spot market behavior.

Focusing on broker margins, the Transport Pro database shows an overall decline from 15.5% in September to 15.3% in October. Within that number, van brokerage margin slipped from 15.5% to 13.8% in October so that is the area of weakness. The interpretation is that many of the low-cost van carriers have left the marketplace. Broker margins for flatbed freight remain mostly unchanged from August levels.

Looking ahead, van and reefer pricing should be able to hold through the Christmas season. Seasonally flatbed rates normally decline towards the end of the year. First quarter 2024 generally sees lower rates, especially from California. El Nino winter conditions should be a positive with warmer weather in the Midwest; wetter, cooler conditions in the South, and plenty of snow in the West. This again, supports the idea of rebound in freight volumes and rates in the 2nd quarter which should be welcome news for all.