Freight Brokers See Progress, Setbacks and Emerging Concerns

August 6, 2024

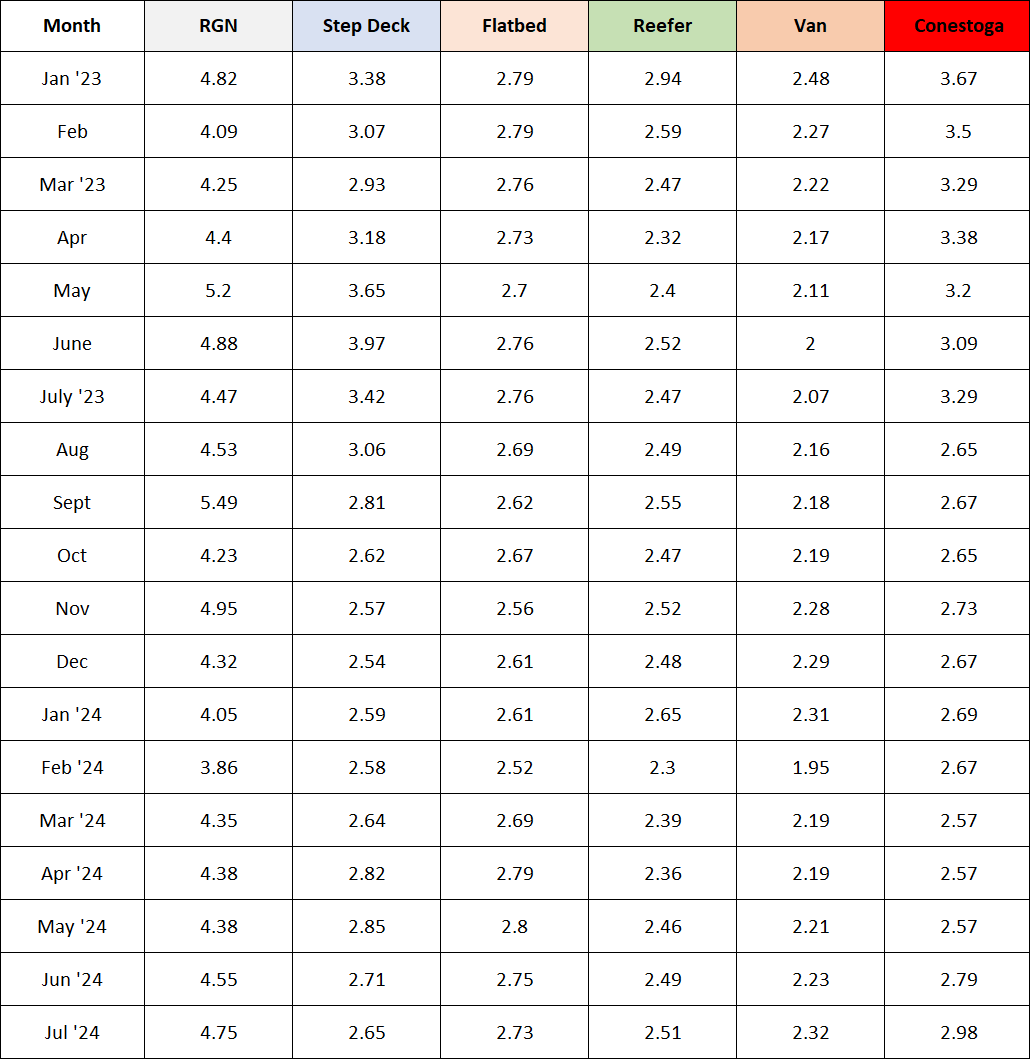

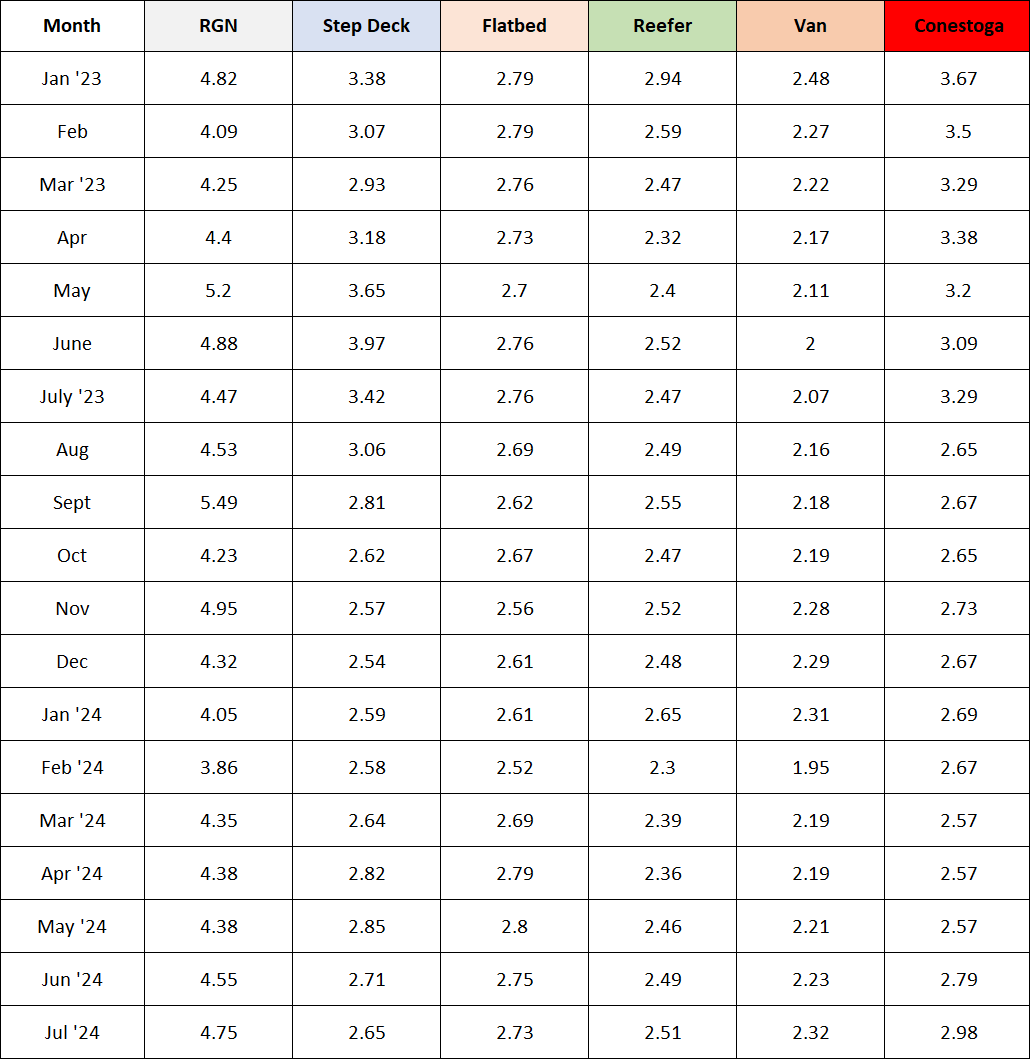

Each month the Transport Pro database produces results for analysis which paints the overall picture of how brokers and truckers are doing. Mixed simply does not fully describe the latest results which show ongoing improvement, back sliding, and areas of concern for brokers. Let’s dig in!

July highlights

Van freight. Van rates took a significant jump from June levels, mostly aided by "Christmas in July" sales events that produced high demand from a number of head haul markets serving major population centers. Elsewhere van demand was soft, reefer demand remained lackluster and flatbed demand flagged. Looking at specialty freight types, standard deck flatbed slipped as well as step deck. Flexible conestoga equipment remained in relatively high demand. RGN equipment posted solid numbers although in a limited count of loads.

Focus on Van Rates

For the third straight month van rates are up. July 2024 marked a high-water mark not exceeded since January 2023 when rates began their precipitous decline. The advance of nine (9) cents per mile represents the most since November 2023. Many evaluators of van truck operations judge $2.30/mile as the break-even point where fleets become profitable. The break-even point varies by individual operation, geography and length of haul, still this is a significant milestone.

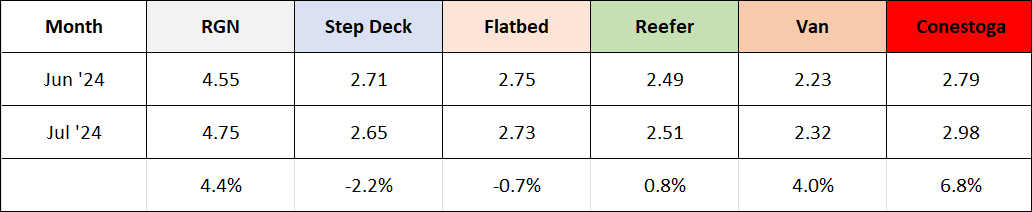

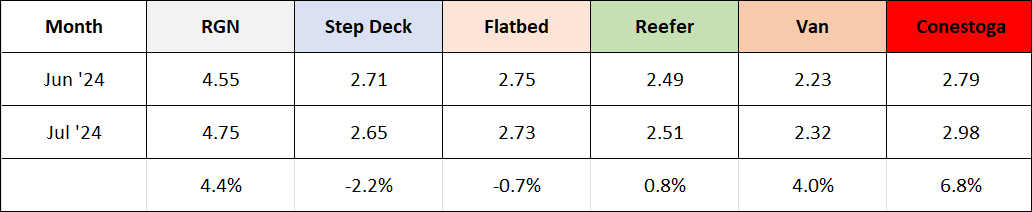

Month-Over-Month Comparison

Aside from van rates, up 4.0%, and conestoga, up 6.8%, there isn't much of a positive take away for carriers. The ugly side is that broker margins fell for van freight, down to 14.4% and reefer margins even lower at just 12.4% which likely reflects a lot of competitive produce moving. It’s been noted elsewhere that restaurants are struggling with high costs and possibly more people are choosing to eat at home, dampening demand.

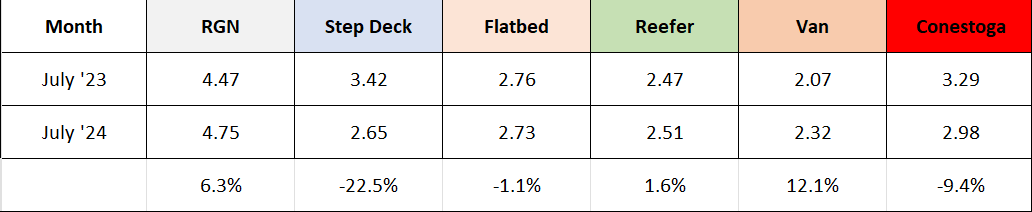

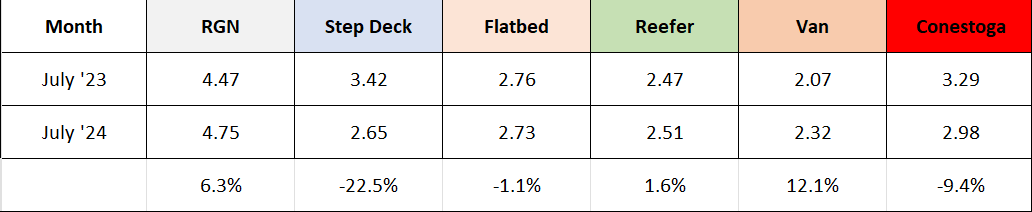

Year-Over-Year Comparison

Looking at the year-year picture it's apparent the flatbed segment hasn't improved and the step deck specialty market has collapsed. Reefer freight is only up 1.6% while costs of operation are much higher. Van freight shows an encouraging +12.1% recovery but brokers are having a hard time meeting top line goals for this segment.

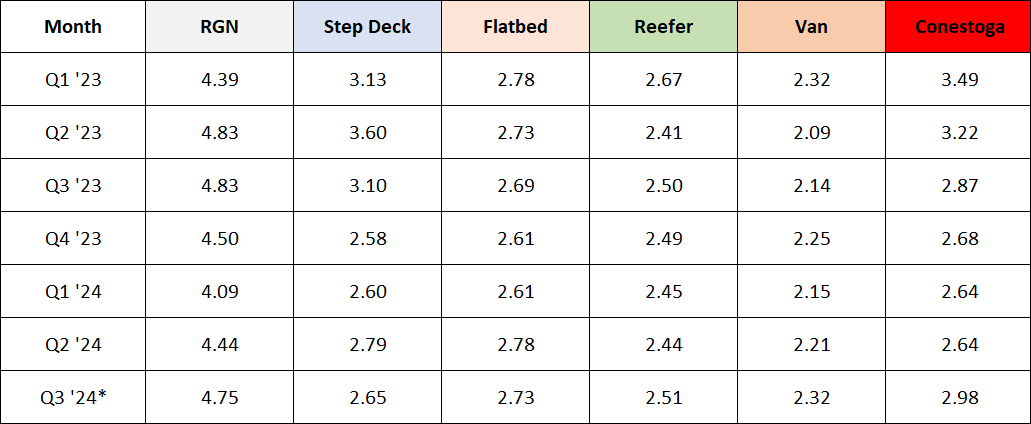

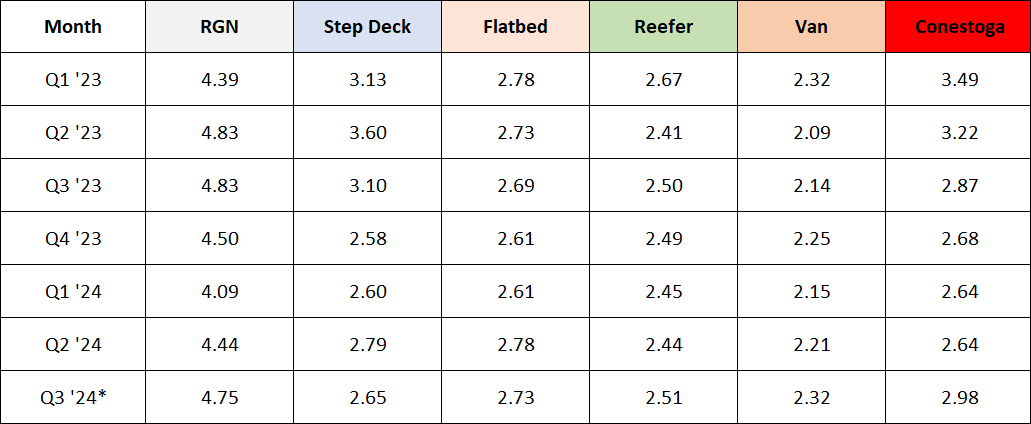

Larger picture - Look by Quarter

Here are quarterly results which provides a different way of looking at nineteen months of data less subject to monthly swings. *July represents the 3rd quarter 2024. There is a lot to the claim that rates have remained largely the same for the last eighteen months, with some low spots sprinkled in.

2nd Half Outlook

The Amazon-powered "Christmas in July" DID appear to help van freight hold up in July. But it's hard to define anything to help avoid a slump during August. A rate cut by the FED remains widely anticipated in September which is also the start of the fall/winter build-up for peak retail season. The forecast is for weaker van rates in August with recovery in September. Weather events remain a wild card but so far have been working against the economy with many regions experiencing excessive heat which can dampen consumption – unless you are an electricity generator.

Broker & Owner-Operator (Purchased) 13-Mo. Recap