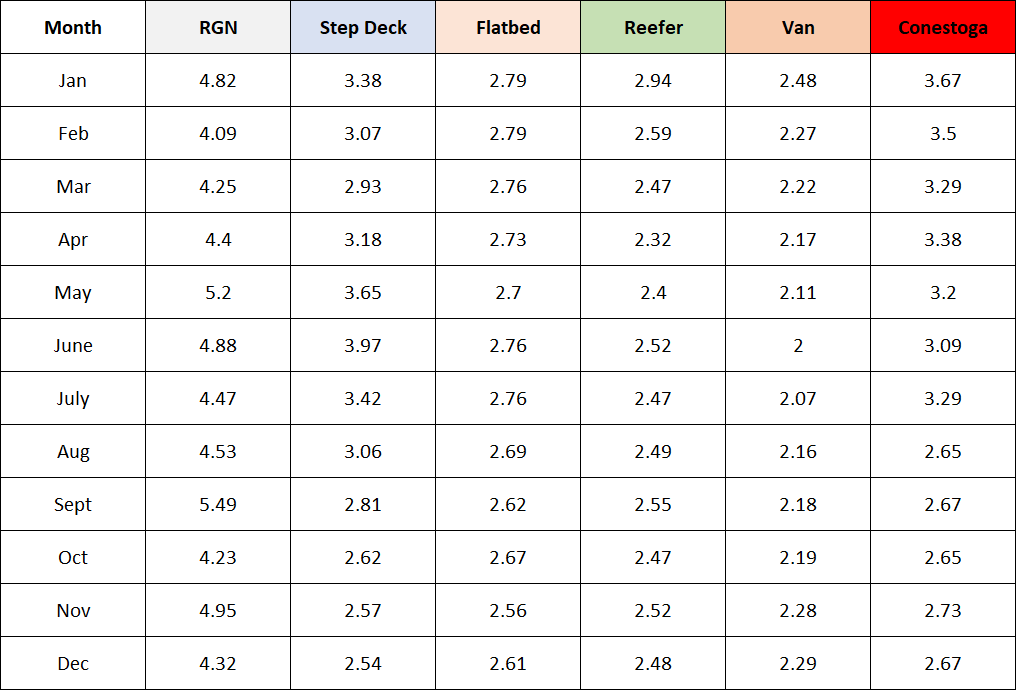

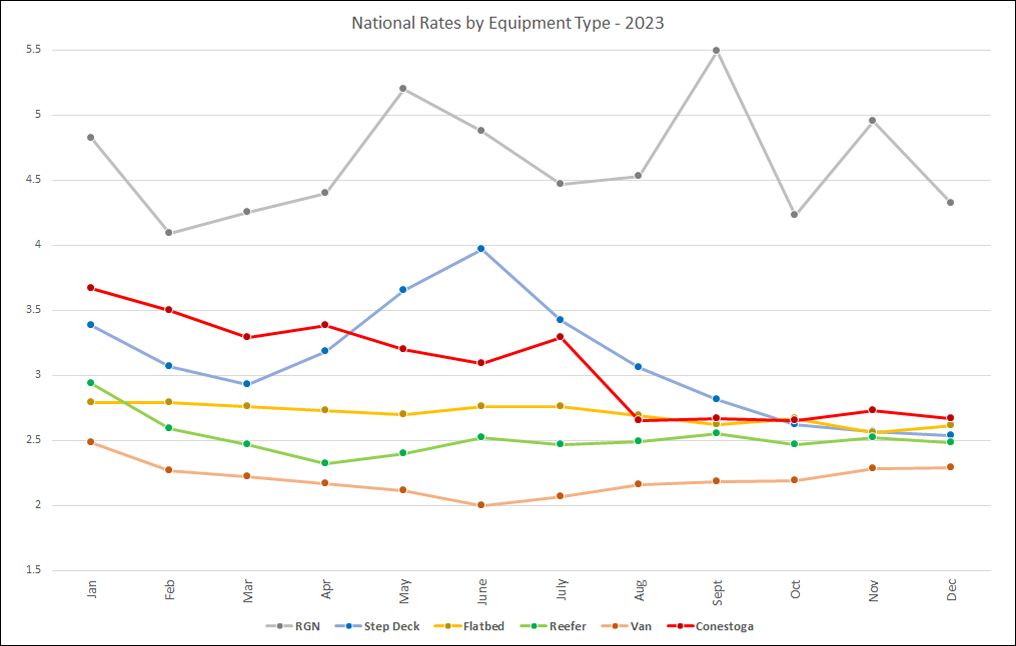

Trucking rates tracked across six categories show emerging consistency. Van purchased transportation

especially shows recovery with November and December levels being two of the three highest levels of

the year. Refrigerated transport has largely held steady after an April-May dip. Multiple measures of

flatbed equipment show rates declining in the most recent six months but beginning to firm.

Let’s focus on van rates, the most common equipment type reported in the Transport Pro database.

January measured at $2.48/mile which plummeted to $2.27/mile in February, hit a low of $2.00 in June

but is back up to $2.28-2.29/mile in the November-December period. A robust Christmas shopping

period and stubborn economy with no drop off in job creation can be credited with the rebound. Rate

levels are such that not every small carrier will survive but combined with declines in fuel price, carriers

have a better chance of making it through the seasonal lulls of the first quarter.

Refrigerated rates also dropped off sharply from the first month of the year. Following a low in April at

$2.32/mile, reefer rates recovered to $2.52/mile in June and have remained close to that figure since with

September recording the post-April peak of $2.55/mile. Operating issues of tight staffing leading to

excess detention are likely more concerning to refrigerated operators than the overall rate level. There is

a lot of discontent and chatter on the trucking forums about switching from hauling refrigerated foodstuffs

to easier commodities in 2024.

Flatbed rates posted the most interesting results in 2023. In short, all flatbed types were in high demand

earlier in the year. Later in the year, specialty flatbed equipment found a niche hauling oversize and over

dimension cargoes. Step decks, RGNs and Conestoga equipment hauling normal dimension freight

tended towards standard deck levels as the year rolled on. Standard 53’ deck equipment dropped from a

high of $2.79/mile in January to a low of $2.56 in November but had a bounce up to $2.61/mile in

December. There is some resiliency in flatbed pricing in the Eastern US but Texas has slowed with less

drilling activity in the back half of the year.

Overall, 2023 can emphatically be stated as a mixed year for brokerage companies, with easy availability

in most of the first half of the year. But as trucking rates firmed and equipment became tighter in many

markets, it became more challenging to make normal margins. Current signs of stability should help

companies to reset. One last note is that Mexico, not China, is now the US largest trading partner.

Growing volumes in lanes between Texas and the rest of the US should continue in 2024. Because of

imbalance, northbound equipment will be at a premium and southbound traffic should be at a discount,

especially to destinations below Dallas/Fort Worth.

The earlier prediction/forecast of a rebound in traffic levels in the Spring remains this analyst’s belief. In

other industries, analysts are calling for a midyear recovery. This is driven by a belief that easing

inflation will allow interest rate cuts, spurring housing, especially in the Southeast region. Energy

production remains high, with the US helping to supply Europe. Transportation usually leads other

economic indicators, especially when inventories are in balance. Any shift or uptick will shift trucking

out of balance and should cause rates to rise. Look for ongoing monthly reports derived from the

Transport Pro database to continue to track these trends.

Rates include fuel surcharge, where applicable. Rates are paid to Carrier by

Brokers.

Notes

Over dimension, overweight, hazmat, LTL moves removed

Each month based upon about 40,000 monthly moves; Van, reefer, flatbed make up 95% of shipments

Flatbed consists of 53’ standard deck shipments; specialty flatbed equipment reported separately (Conestoga, RGN, Step Deck)