April Rate Trends Mixed Among Uncertainty

May 1, 2024

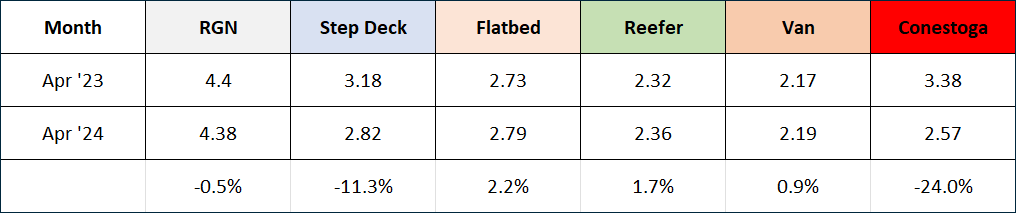

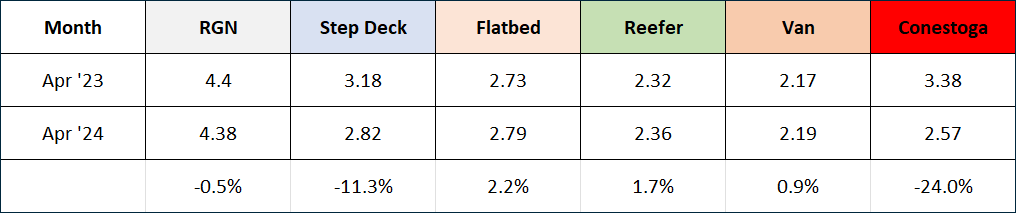

April results show a continuation of March-like numbers. Both rates at the national level and margins nearly

match March with the exception of Step Deck freight which trended higher with tighter margins. Van freight

held at $2.19/mile, a small win for carriers as van rates often drop in April. Flatbed rates rose $0.10 per mile

from $2.69 to $2.79/mile. Reefer rates were down slightly from $2.39 to $2.36/mile, likely due to an early

Easter which accelerated food shipments into March.

April Historically Mixed

Past years often show a slump in April activity after the March quarterly close. The fact that van rates held

represents a small positive because diesel fuel has dropped in price. The benchmark WTI oil price has

declined 8.3% since an April 5 peak representing a savings of 1-2 cents per mile in pump prices so far.

Flatbed pricing rising 3.7% while margins are maintained is good news for that segment. Step Deck pricing

rose a robust 6.8% as Spring construction season proceeds.

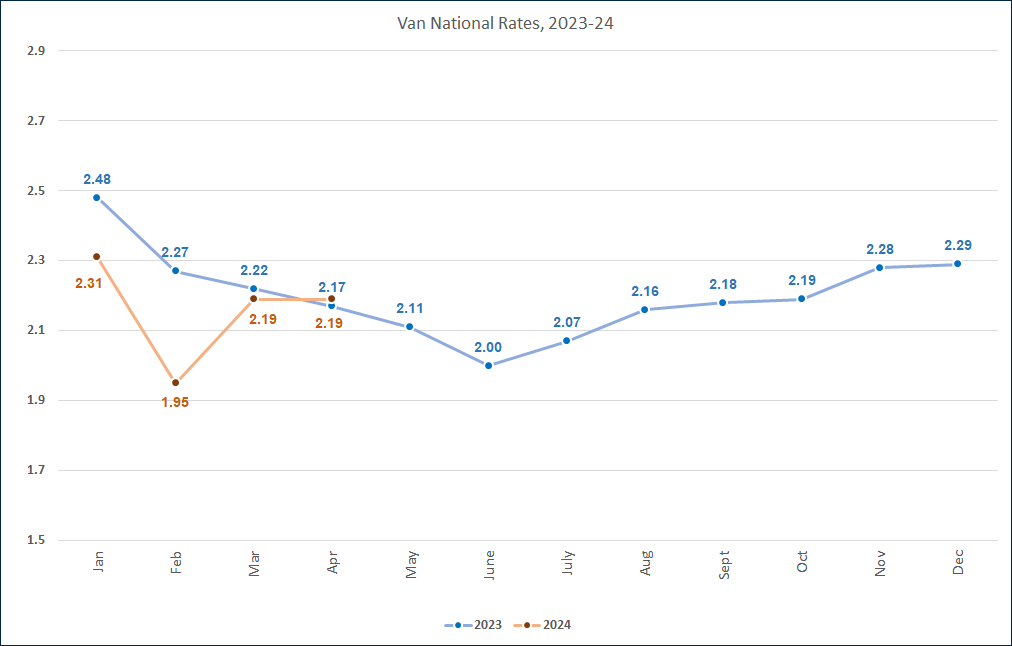

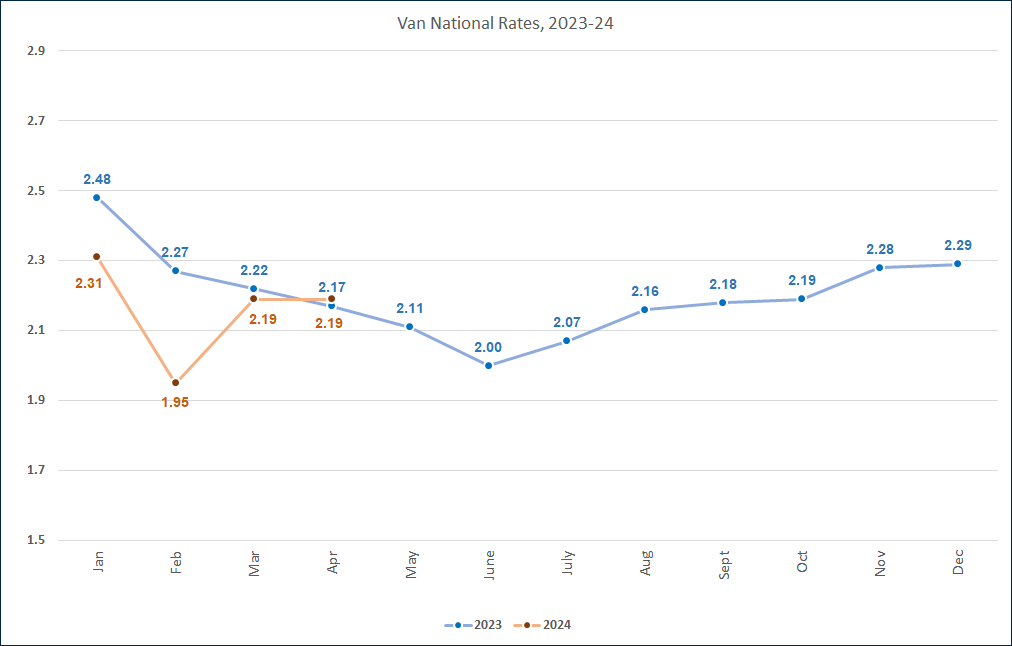

Focus on Van Rates

Prices on van freight are actually two cents per mile higher than in April 2023. The rebound from February

record lows has thus held. This price level is further confirmed by analyzing factored van freight data which

measured at a nearly identical $2.20/mile.

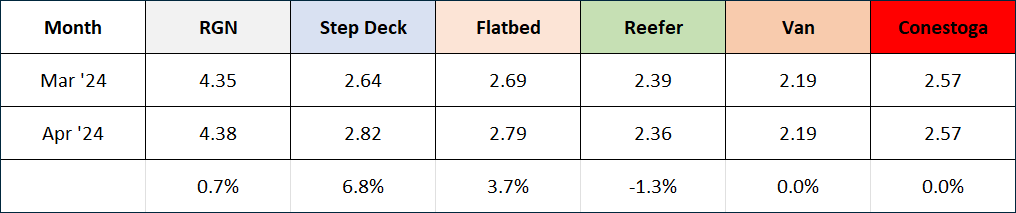

Year-Over-Year Comparison

Flatbed reefer and van rates all beat their Y-O-Y comparable although by small percentages. Specialty

flatbed types though were all lower, especially Conestoga hybrid van-flat equipment.

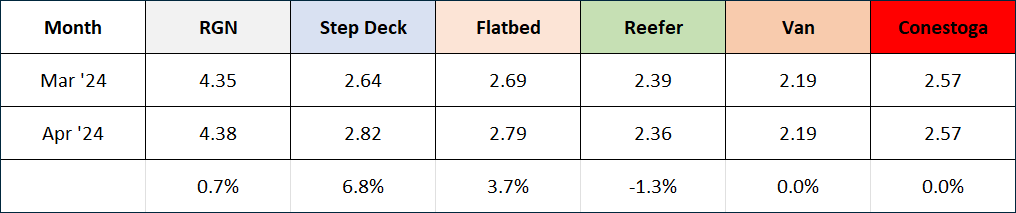

Month Over Month Comparison

The monthly comparison is unremarkable. These numbers echo the larger economy which is awaiting a

signal on which way it will break. Worse case now appears to be a ‘soft landing’ as the jobs report came in

weaker than expected while the overall economy continues to grow as a slow pace. The second quarter

historically is the strongest for the spot market and pricing gains should be expected in May and June

although they were absent in 2023.

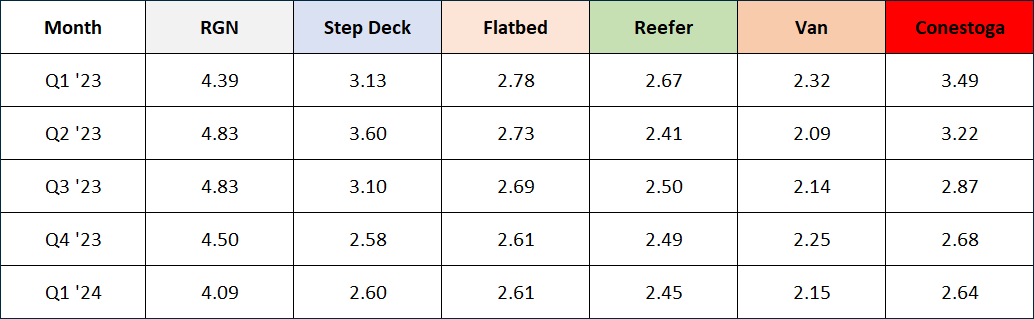

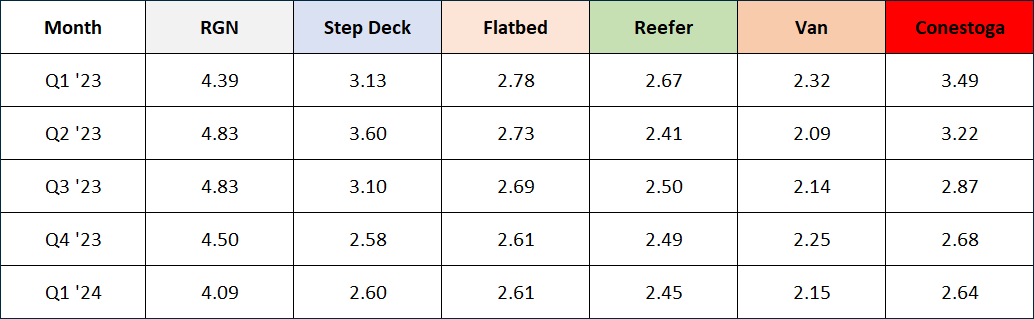

Larger picture - Look by Quarter

Here are quarterly results which provides a different way of looking at fifteen months of data less subject to

monthly swings-

May-June Outlook

The freight spot market has now had a full year to wring out excess capacity. The overall economy retains

enough strength that results should move in a positive direction through June. Low brokerage margins of

14.0% for van freight and 14.4% for reefer freight in April continue to be of concern. Lower diesel fuel

prices could help but world events continue to threaten volatility.

Flooding in the Houston market and severe weather elsewhere continue to wreak havoc on normal operating

conditions. Supply chains continue to be disrupted by War and the Panama Canal bottle neck. While a Fed

rate cut could help, these external events remain of concern. The Transport Pro database will continue to be

mined and reported on monthly so you can stay up-to-date on national trends.