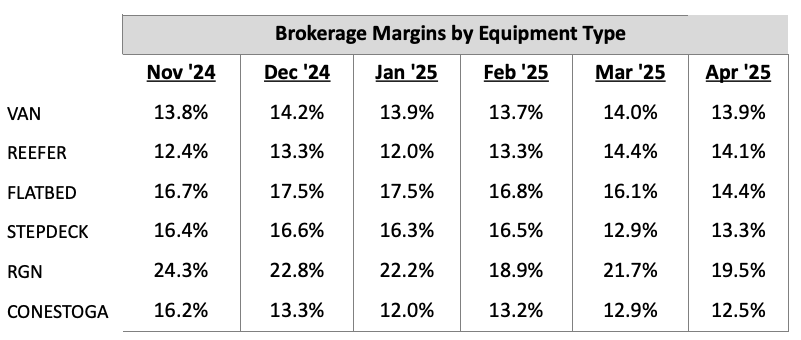

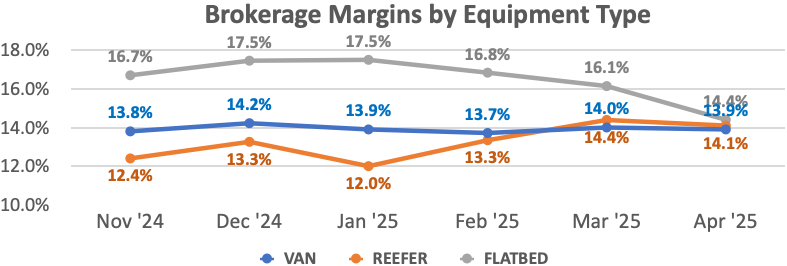

This month looks at a variety of numbers; brokerage margins, length of haul, foreign shipments, and overall shipments in addition to key freight rates. Brokerage margins, for example continue to be under pressure, slipping lower for flatbed, reefer, and van truckloads. Rate rose, at least a little, for those same categories. Length of haul dropped for van and flatbed shipments. Some of these changes are subtle but taken together, they suggest a marketplace under pressure.

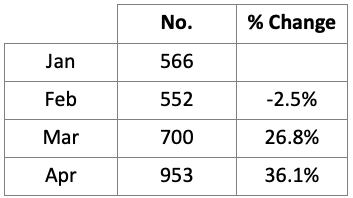

The most significant change found in Transport Pro data consists of a big change in the number of International shipments (excluding Canada). From February to March, shipment count increased +26.8% and then, from March to April, increased +36.1%. The domestic portion of these shipments certainly had an impact on US markets considering the size of the swing in volumes. From January to February the change was essentially flat. Y-O-Y the change from April 2024 to April 2025 measures +72.6%.

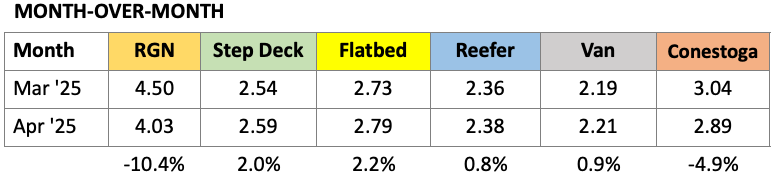

Van, reefer, and flatbed rates moved higher. Domestic volumes were actually down despite similar working days in March and April. The sharper increase in flatbed rates suggests movements of steel and other flatbed commodities for import/export drove rates higher-

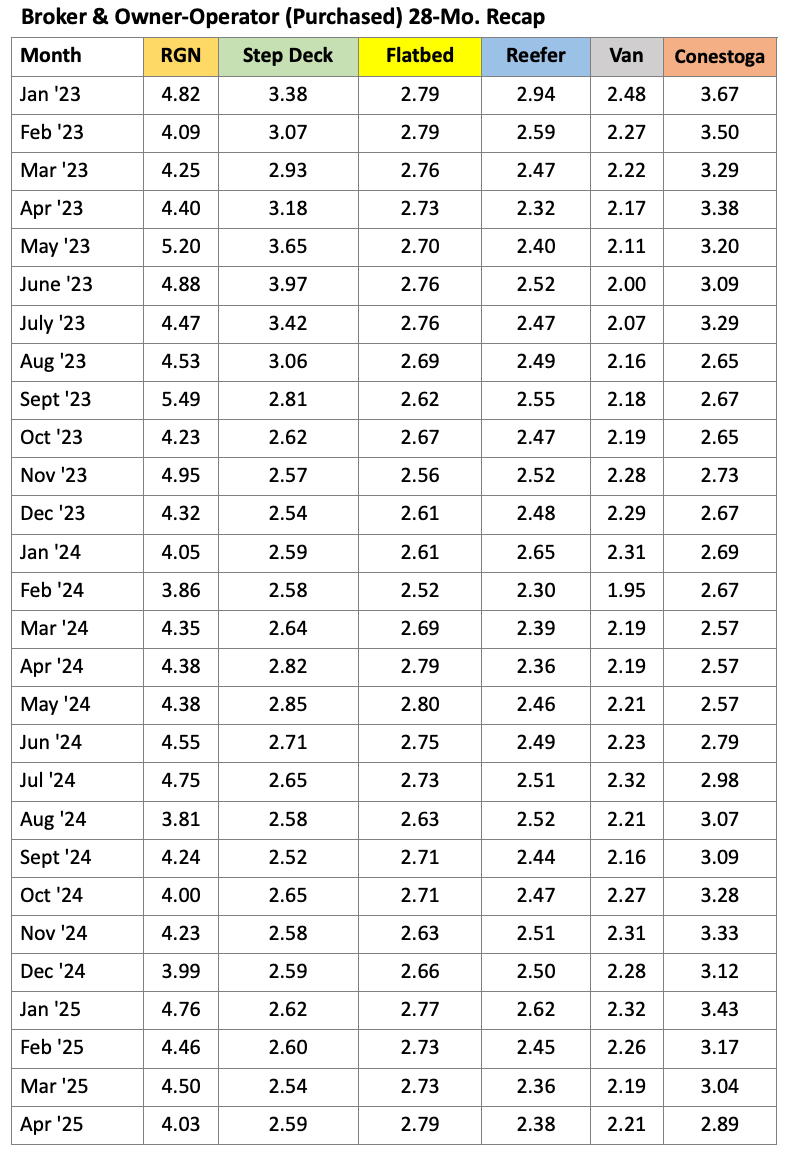

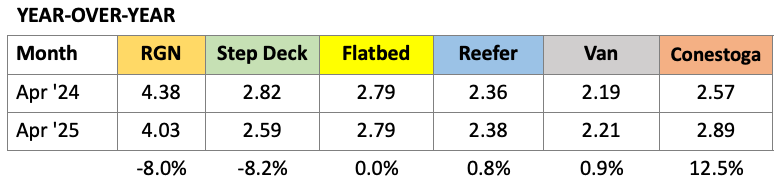

The year-over-year (Y-O-Y) results are unremarkable. Less expensive fuel, a waffling economy faced with uncertainty, and essentially the same numbers in 2025 as 2024.

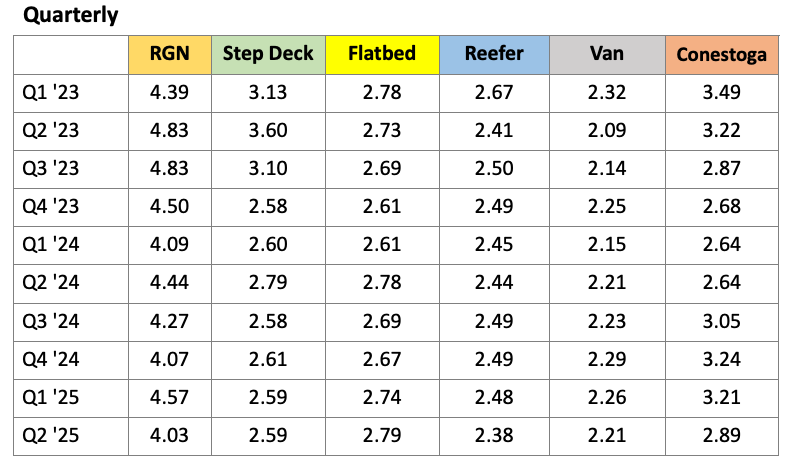

The Quarterly results are somewhat more revealing. Reefer numbers for April fall below any prior quarter tracked. Flatbed numbers are at the top of the scale. Van numbers look much like 2Q 2024.

The freight economy continues to be mixed. Margins have been weak for an extended period while freight rates have shown some improvement from early 2024 and late 2023. Activity is surging for flatbed freight but likely only in response to the threat of steel and aluminum tariffs on international shipments. Length of haul is changing month-month for van and flatbed freight while reefer has been relatively stable. Lower fuel costs also indirectly affect freight rates, allowing marginal operators to remain in business.

The near total cut-off of Chinese imports should increasingly show up in May and June shipments. With fewer carriers performing long haul to the West Coast, equipment surplus should begin to show in the eastern U.S. resulting in better brokerage margins. Shorter lengths of haul might not negatively affect rates measured at the national level but certain lanes dependent on imports will drop sharply.